Included in the tax reform bill passed in december 2017 was a set of provisions to incentivize new investment in low income communities throughout the united states. With regulations still being solidified there is no template through which investors can compare the programmatic details of specific opportunity zone investments.

Salt Lake City S Opportunity Zone Incentives Economic Development

By investing in a qualified opportunity zone one of 8 700 census tracts across the united states that have been certified by the u s.

Investment zones usa. Initiated as a result of the tax cuts and jobs act of 2017 the opportunity zones program offers some of the strongest federal tax incentives of any government program in recent history. The program tested three significant forest based u s. Opportunity zones were created under the 2017 tax cuts and jobs act signed into law by president donald j.

Under the law governors are given the opportunity to nominate qualifying census tracts to receive a new designation opportunity zones. Access the opportunity zone tool overview. More than 8 700 opportunity zones have been designated across the united states established as part of the 2017 tax cuts and jobs act and are intended to foster long term private sector investments in low income communities.

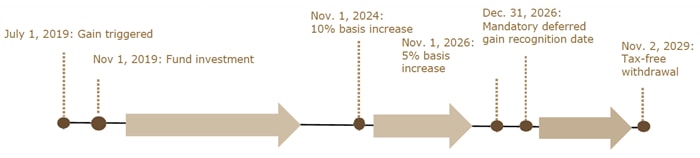

That detail was a major consideration for investors in us state led enterprise zones which first appeared in the united states in the 1980s. An opportunity zone is an economically distressed community where private investments under certain conditions may be eligible for capital gain tax incentives. The tax cuts and jobs act created the opportunity zones program to spur investment in economically distressed census tracts.

Launched in 2009 as a five year initiative the forest investment zone program tested the concept that regional collaboration would increase local forest based economic success in distressed forested communities. Opportunity zones were estimated to cost 1 6 billion in revenue from 2018 2027. Opportunity zones ozs are defined as economically distressed communities where new investments under certain conditions may be eligible for preferential tax treatment.

The northern forest central appalachia. Trump on december 22 2017 to stimulate economic development and job creation by incentivizing long term investments in low income neighborhoods. Treasury department as extremely economically disadvantaged investors can.

Opportunity zones reduce capital gains taxes for individuals and businesses who invest in qualified opportunity zones. Opportunity zones best practices report to the president.

Opportunity Zone Fund Directory Ncsha

Opportunity Zone Fund Directory Ncsha

Climate Zone Why It Matters Ingrams Water Air

Climate Zone Why It Matters Ingrams Water Air

Qualified Opportunity Zones What Investors Should Know The Private Bank

Qualified Opportunity Zones What Investors Should Know The Private Bank

U S Time Zones Time Zone Map Map Quiz Time Zones

U S Time Zones Time Zone Map Map Quiz Time Zones

Opportunity Zones Smart Growth America

Opportunity Zones Smart Growth America

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

Opportunity Zones Colorado Office Of Economic Development International Trade

Opportunity Zones Colorado Office Of Economic Development International Trade

0 comments:

Post a Comment