Investment Demand Curve Macroeconomics

The investment demand curve. In the long run the investment will increase the economy s capacity to produce which shifts the lras curve to the right.

Reading Loanable Funds Macroeconomics

Reading Loanable Funds Macroeconomics

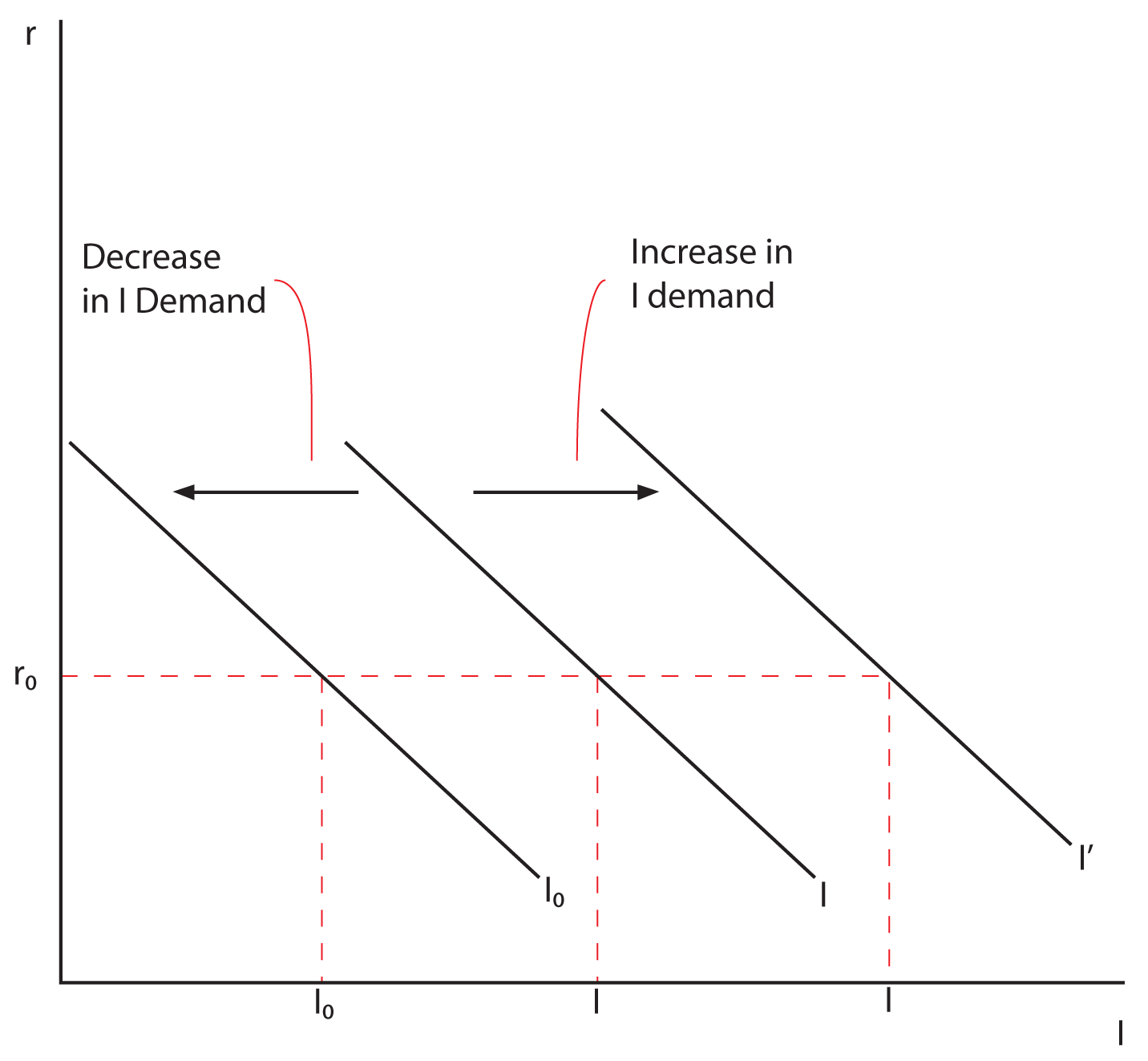

It is a downward sloping curve depicting a negative correlation between gross investment and the lending rate of interest.

Investment demand curve macroeconomics. 4 a shows that an expansionary shift in demand raises equilibrium price which shows in fig. To show the relationship between interest rates and investment. Investment changes the capital stock.

13 4 b that the increase in housing price increases residential investment. Investment increases demand z increases y increases further through multiplier effect changes in interest production don t cause shifts only make mov ts along curve remember that investment is now a function of interest and output no longer exogenous. Shifts in the investment demand curve.

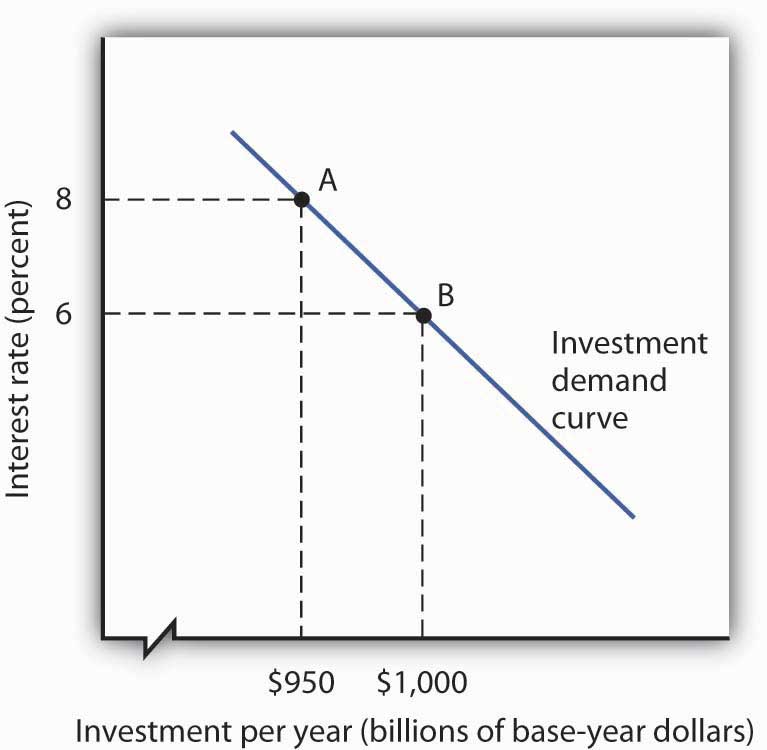

Investment is a component of aggregate demand. Economists use a schedule called the demand. In analyzing the determinants of investment we focus particularly on the relationship between interest rates and investment is crucial because interest rates influenced by central banks are the major instrument by which governments influence investment.

Changes in the capital stock shift the production possibilities curve and the economy s aggregate production function and thus shift the long and short run aggregate supply curves to the right or to the left. Since consumption function is more or less stable in the short run investment demand is of crucial importance in the determination of income and employment. The demand curve can shift for an economic boom a large increase in population and a fall in interest rate.

When the demand for housing increases the equilibrium price changes which in turn affects residential investment. The slope of the is curve. In the keynes s two sector model aggregate demand consists of two constitu ents consumption demand and investment demand.

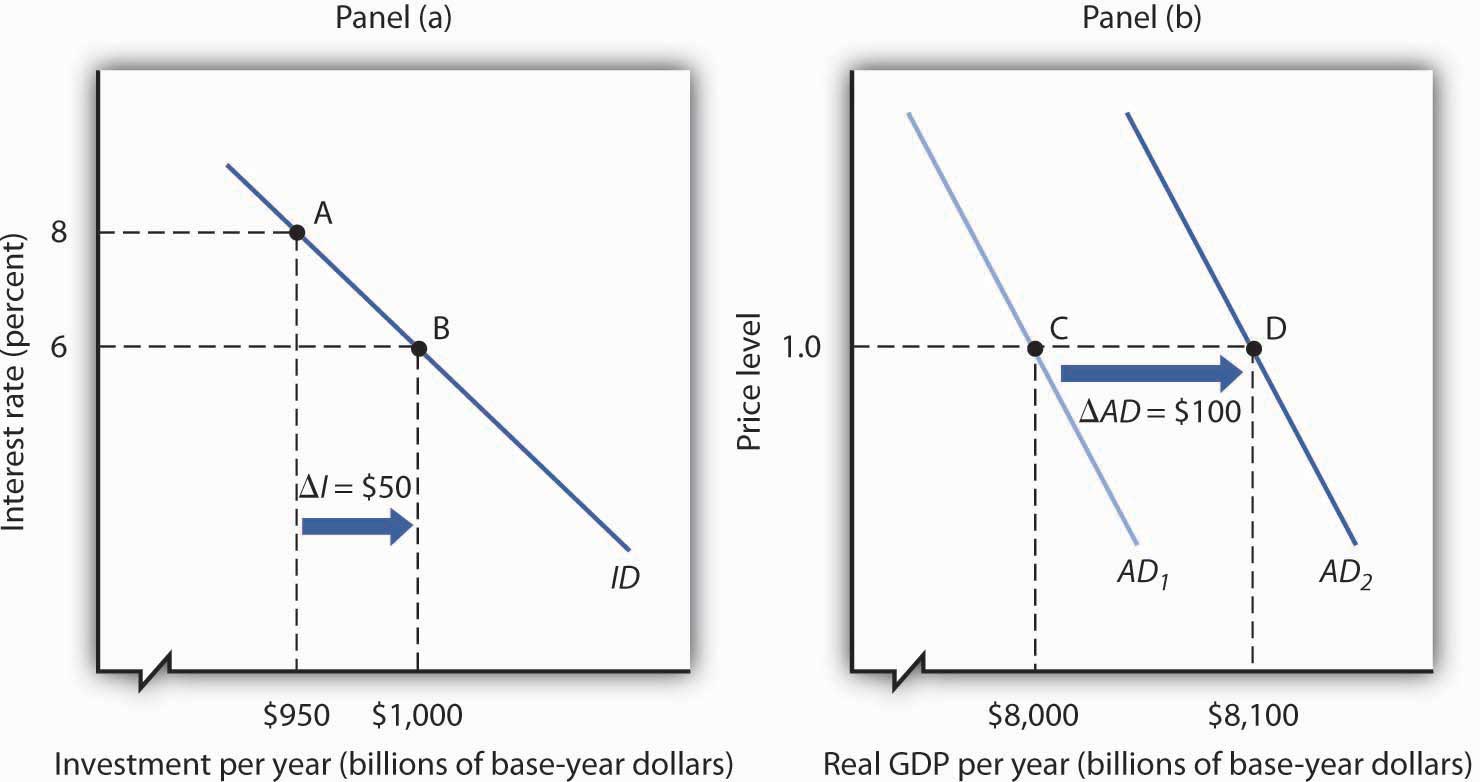

For example an increase in the gdp will shift the investment demand curve out as shown in figure 2 10 a on the next page. Finally note the importance of expectations. The initial impact of investment is on the ad curve which shifts to the right as investment i is a component of ad show shown below.

We have seen how interest rates affect the level of investment investment is affected by other forces as we. The is curve is negatively sloped because a high er level of the interest rate reduces investment spend ing thereby reducing aggregate demand and thus the equilibrium level of income. Changes in investment shift the aggregate demand curve by the amount of the initial change times the multiplier.

The investment demand curve or simply the investment schedule is a locus of points each representing a combination of gross investment demand i and the rate of interest r within a given time period.

Macroeconomics Investmen No Bull Economics Lessons

Deficient Demand Effects And Causes Macroeconomics

29 2 Determinants Of Investment Principles Of Economics

29 2 Determinants Of Investment Principles Of Economics

Kaylaa S Ap Macroeconomics Investment Demand Curve Id

Kaylaa S Ap Macroeconomics Investment Demand Curve Id

Investment Demand In Macroeconomics An Overview

Investment Demand In Macroeconomics An Overview

Marginal Efficiency Of Capital Mec And Investment Demand Function Businesstopia

Marginal Efficiency Of Capital Mec And Investment Demand Function Businesstopia

Gonda S Ap Macroeconomics Blog Unit 3 Investment Demand Real V Nominal

Post a Comment for "Investment Demand Curve Macroeconomics"