The company paid a 50 down payment and the balance will be paid after 60 days. Understand the difference between transactions among partners transactions between the.

Accrued Expense Journal Entry Examples How To Record

Accrued Expense Journal Entry Examples How To Record

In a journal entry debit your cash account by the amount you receive and credit the investment account by the same amount.

Initial investment journal entry. For example if the acquired company pays your small business an 8 000. The long term investment is normally made for earning interest or. This will result in a compound journal entry.

Prepare a journal entry to record this transaction. Initial equity method investment. The journal entry to recognise an increase in the fair value of a financial asset or the.

The investment is debited and cash or bank is credited as case may be. Government semi government corporation or trust securities such as shares bonds debentures etc. Investments are made in various securities e g.

Journal entries increase in value of asset decrease in liability. Investment in subsidiary journal entry abc company purchase 30 000 shares in xyz for 5 each shares. The journal entries would be.

The first of the equity method journal entries to be recorded is the initial cost of the investment of 220 000. The investor is deemed to exert significant influence over the investee and therefore accounts for its investment using the equity method of accounting. There is an increase in an asset account debit service equipment 16 000 a decrease in another asset credit cash 8 000 the amount paid and an increase in a liability account.

Accta february 9 2018 journal entry examples. Sam contributes 100 000 cash to the partnership. To illustrate sam sun and ron rain decided to form a partnership.

Journal entry to record the investment by owner. In long or short term. For the purposes of this illustration we ll pretend none of the change in value is due to a change in credit risk.

On december 7 the company acquired service equipment for 16 000. Read this article to learn about the transactions relating to investment account with its treatment. That determination is made at initial recognition and is not reassessed.

Ron is also going to transfer the 20 000 note on the automobile to the business. Ron is going to give 25 000 cash and an automobile with a market value of 30 000. Purchase and sale of investments.

Learn the general journal entries for an initial investment and subsequent transactions in a partnership. Next q1 owner invested 700 000 in the business.

Principles Of Accounting Journal Entries Journal Principles

Principles Of Accounting Journal Entries Journal Principles

Journal Entry Definition Format Examples Journal Entries Journal Education

Journal Entry Definition Format Examples Journal Entries Journal Education

Revalutaion Of Fixed Assets Meaning Purpose Journal Entry Methods Fixed Asset Finance Investing Financial Accounting

Revalutaion Of Fixed Assets Meaning Purpose Journal Entry Methods Fixed Asset Finance Investing Financial Accounting

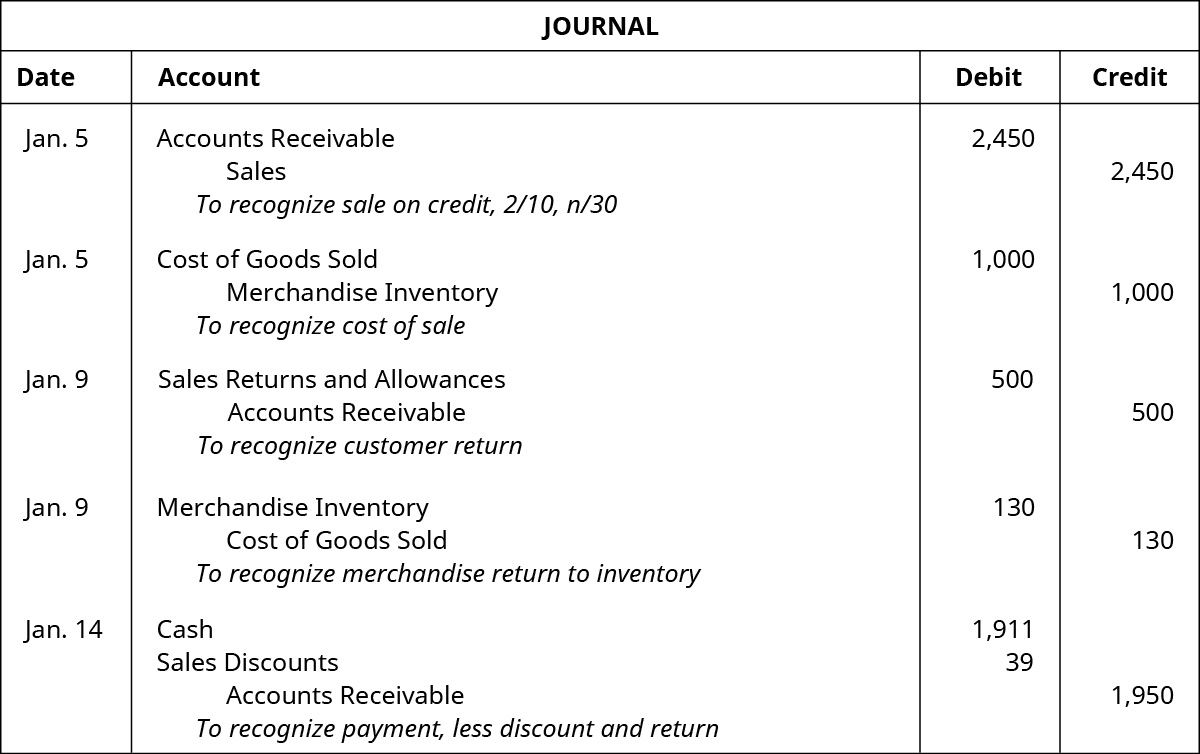

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

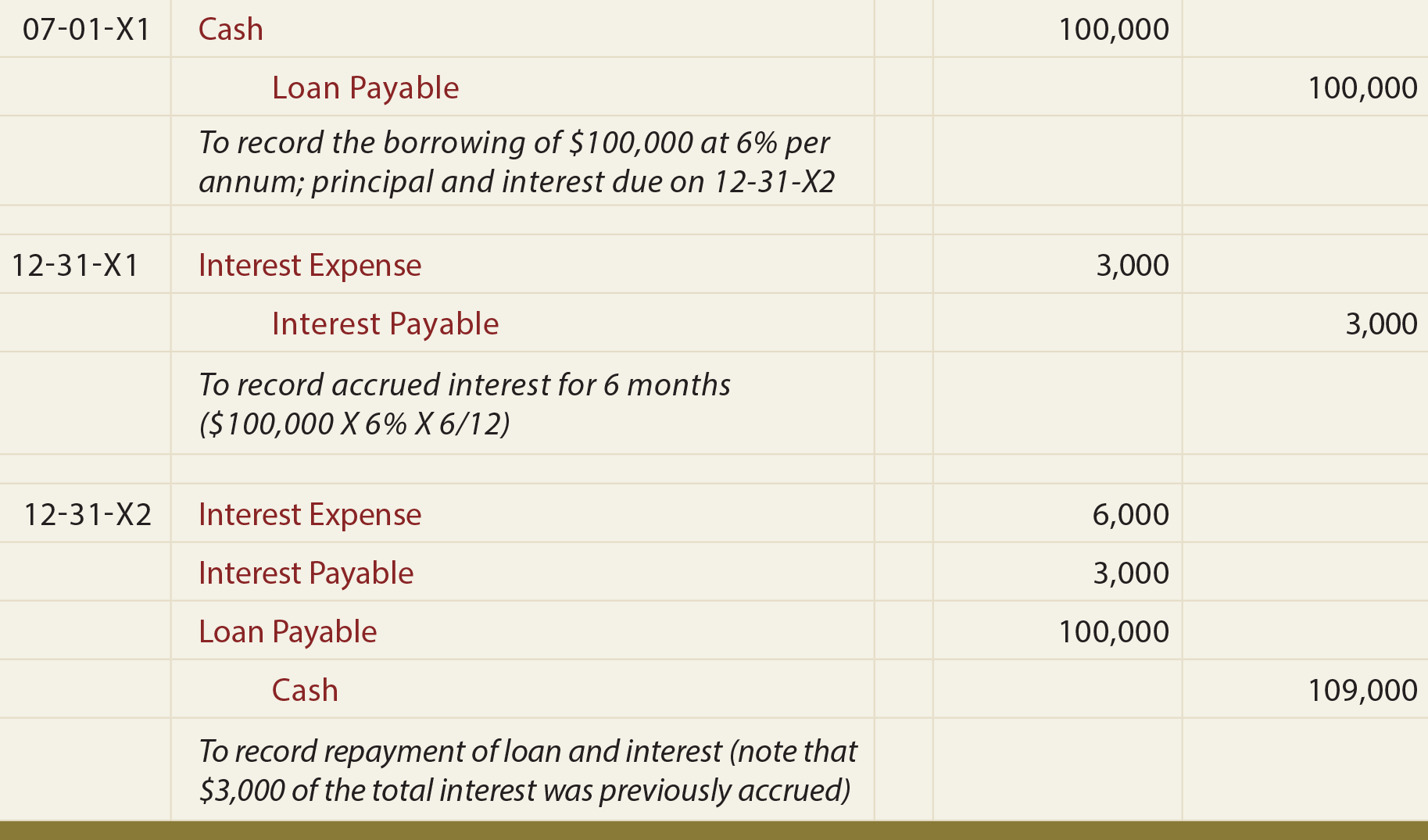

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Initial Recordings Are The First Entries For Payroll Accounting For These Entries Record The Gross Wages Your E In 2020 Quickbooks Payroll Payroll Payroll Accounting

Initial Recordings Are The First Entries For Payroll Accounting For These Entries Record The Gross Wages Your E In 2020 Quickbooks Payroll Payroll Payroll Accounting

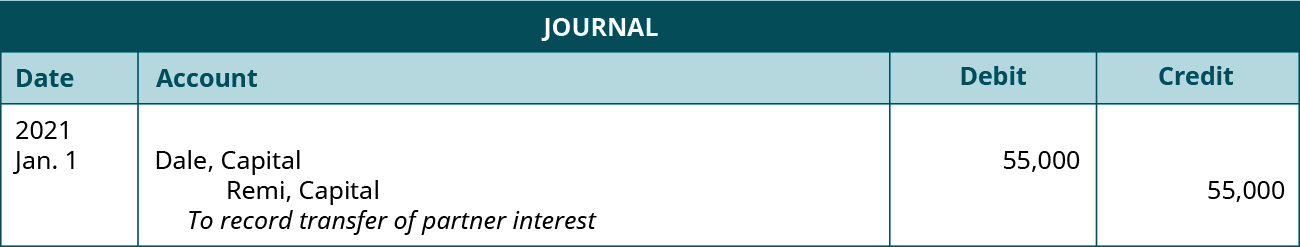

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

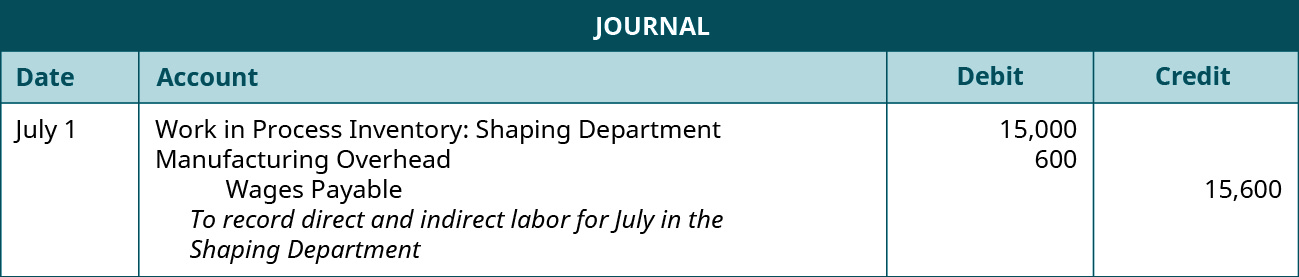

Prepare Journal Entries For A Process Costing System Principles Of Accounting Volume 2 Managerial Accounting

Prepare Journal Entries For A Process Costing System Principles Of Accounting Volume 2 Managerial Accounting

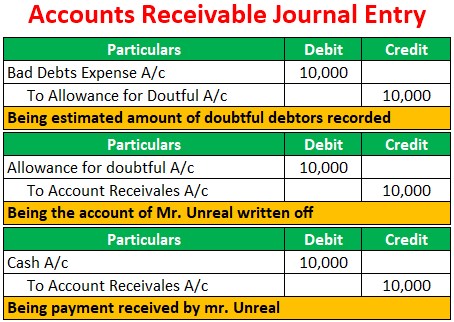

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Journal Entry Business Started With Cash How To Pass A Journal Entry Journal Entries Starting A Business Journal

Journal Entry Business Started With Cash How To Pass A Journal Entry Journal Entries Starting A Business Journal

Receive A Loan Journal Entry Double Entry Bookkeeping

Receive A Loan Journal Entry Double Entry Bookkeeping

0 comments:

Post a Comment