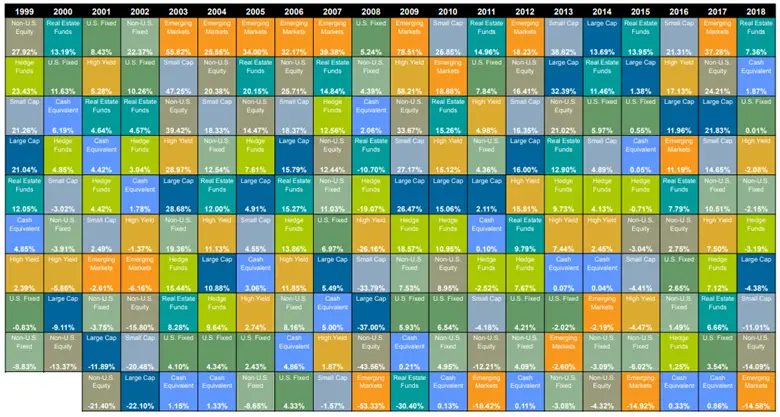

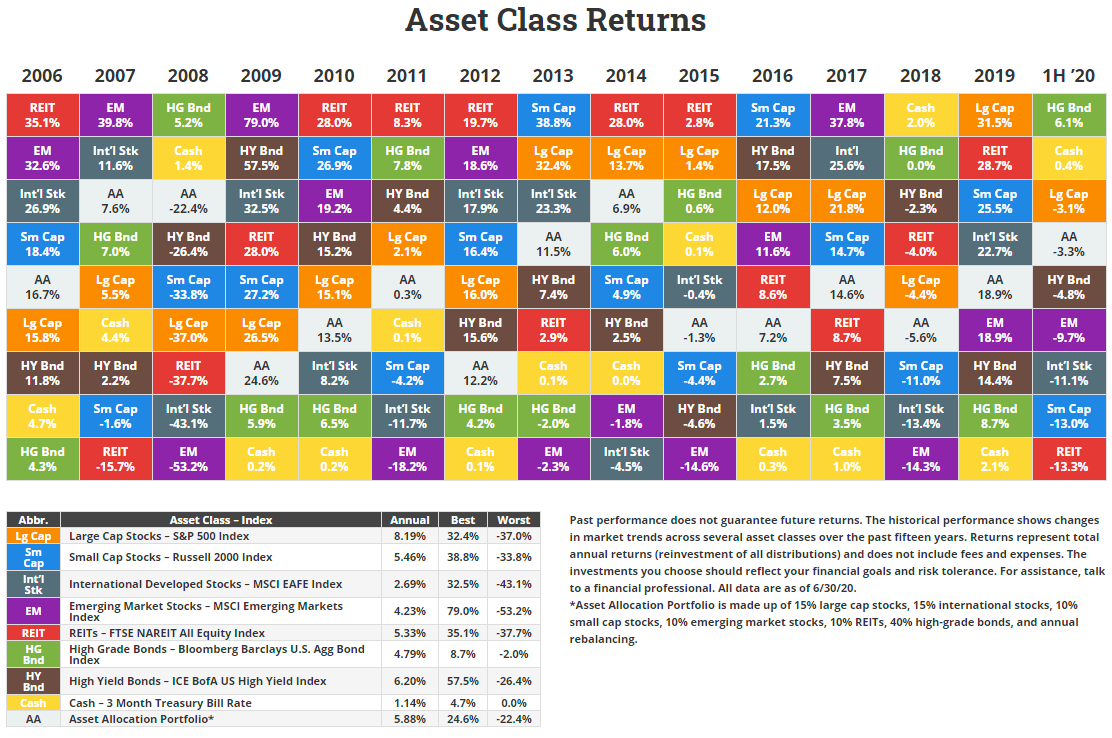

Or consider real estate s rise and fall in 2006 42 and 2007 11. We usually use the quilt chart to show the importance of diversifying across broad asset classes as we did in our previous report in this series.

7 Things To Learn From The Periodic Table Of Investment Returns White Coat Investor

7 Things To Learn From The Periodic Table Of Investment Returns White Coat Investor

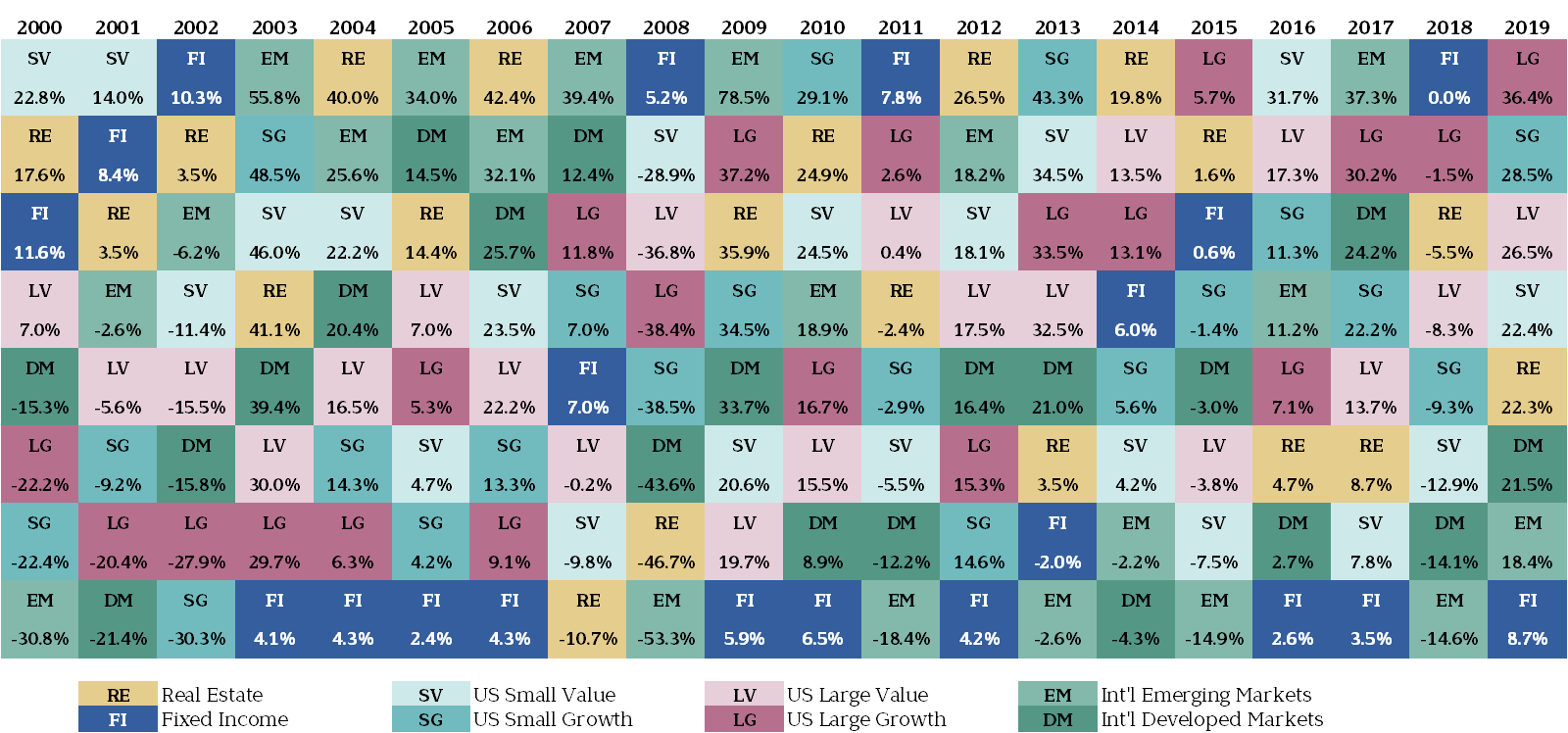

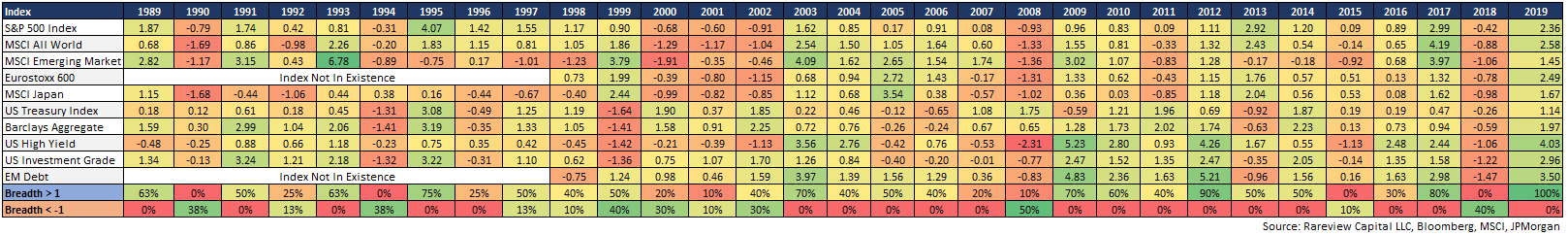

Created by jay kloepfer in 1999 the table features well known industry standard market indices as proxies for each asset class.

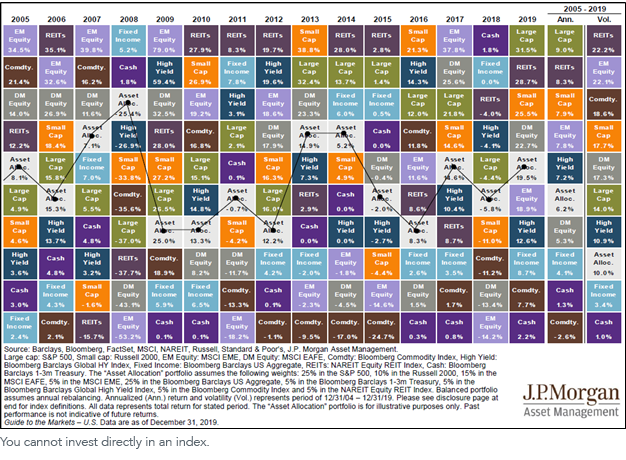

Investment quilt chart 2020. Growth continued to trounce value this quarter with a 28 rebound for the russell 3000 growth and a 15 return for the russell 3000 value. The charts may be a helpful tool in demonstrating the importance of diversification since each investment category tends to vary in performance from year to year relative to other asset categories. The annual update of my favorite performance chart drew a number of good responses and questions.

Q2 2020 market highlights domestic equity market cap and style. I ve updated it every year since then. We ve already reached that point in the new year.

Every year northwestern mutual stitches together something we affectionately call the quilt it s a color coded chart that ranks various asset classes by their total return in a given year ranked from highest to lowest. When we look at annual returns for investments as different as stocks and bonds it allows us to see a range of returns from big gains to big losses in a given year particularly during bear market environments. Posted january 16 2020 by ben carlson.

Cfi s financial model template library has hundreds of free excel file downloads to help you become a world class financial analyst. Mapping this over the span of 15 years produces a chart that looks something like the periodic table or a quilt. The first asset allocation quilt i put together was in 2014.

Small and equity markets u s. Just look at emerging markets returning 37 in 2017 and 14 in 2018. Our quilt charts show the leaders the losers and everything in between for each of the past 10 years.

One year s best performer can readily be the next year s worst. The callan periodic table of investment returns annual returns for key indices rank ed in order of performance 2000 2019 the callan periodic table of investment returns conveys the strong case for diversification across asset classes stocks vs. The past 10 years have felt like complete and utter domination by large cap u s.

From a market cap standpoint trends. Bonds capitalizations large vs. The enduring appeal of the table is its ability to be understood at a glance says kloepfer.

The callan periodic table of investment returns graphically depicts annual returns for various asset classes ranked from best to worst. Perceived patterns can deceive. Explore and download the free excel templates below to perform different kinds of financial calculations build financial models and documents and create professional charts and graphs.

Can you take this allocation quilt back 20 years. List of financial model templates. I m going to go through two that i thought were worth some more digging.

It s become an annual tradition to forget about it until a few people email me asking for an update. On the year growth is now ahead of value by over 25 the widest margin for a 6 month period since 1999. Updating my favorite performance chart for 2019.

In fact as our quilt chart conveys there may be few faster ways to lose investment muscle.

Three Lessons Covered By Our Quilt Chart Vista Capital Partners

Three Lessons Covered By Our Quilt Chart Vista Capital Partners

Asset Class S P 500 Annualized Total Return Chart Business Insider

Economic Outlook Recap And Updated Quilt 2020 Boyd Wealth Management

Economic Outlook Recap And Updated Quilt 2020 Boyd Wealth Management

Factor Diversification And Why It Matters In A New Market Regime Wisdomtree

Factor Diversification And Why It Matters In A New Market Regime Wisdomtree

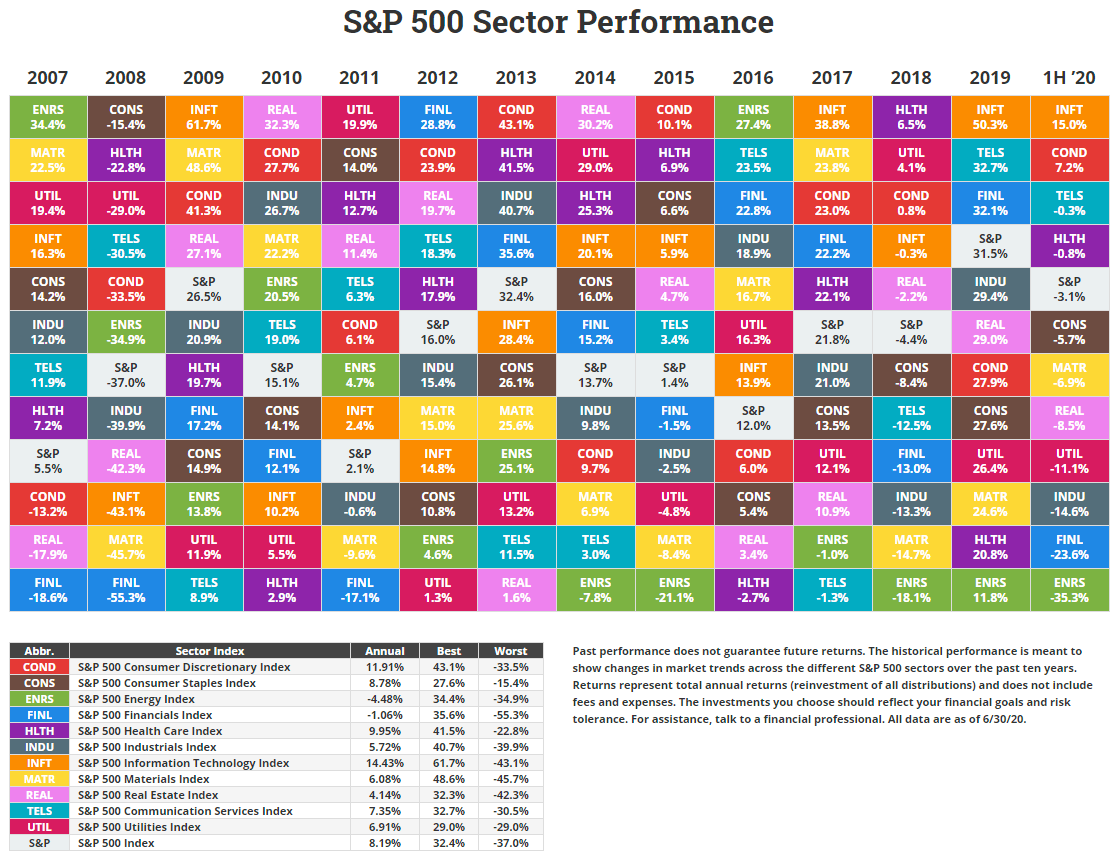

Annual S P Sector Performance Novel Investor

Annual S P Sector Performance Novel Investor

Callan Periodic Table In The 2020 S Two Decades In Review

Callan Periodic Table In The 2020 S Two Decades In Review

Our Investment Quilt For 2020 Is Sewn With Diversification Rareview Capital Llc

Our Investment Quilt For 2020 Is Sewn With Diversification Rareview Capital Llc

Updating The Asset Allocation Quilt For 2018 Fleming Watson Financial Advisors

Updating The Asset Allocation Quilt For 2018 Fleming Watson Financial Advisors

Annual Asset Class Returns Novel Investor

Annual Asset Class Returns Novel Investor

Lessons From The Quilt Chart Us Sectors Ubs Global

Your Monday Dirty Dozen Chart Pack Macro Ops

Your Monday Dirty Dozen Chart Pack Macro Ops

0 comments:

Post a Comment