Additional Investment Journal Entry

Investments are made in various securities e g. In long or short term.

How To Record A Loan From A Friend Double Entry Bookkeeping

How To Record A Loan From A Friend Double Entry Bookkeeping

There is an increase in an asset account debit service equipment 16 000 a decrease in another asset credit cash 8 000 the amount paid and an increase in a liability account.

Additional investment journal entry. Description of journal entry. Treasury stock cost method par value method. Supplies on hand was 3 100 services revenue of 22 500 must be accrued.

To captital a c explanation. Capital being liability of the firm as per business entity principle is increased and an. Journal entry to record the investment by owner.

Purchase and sale of investments. Journal entry to record the investment by owner. Prepare a journal entry to record this transaction.

Top 10 examples of journal entry. 30000 cash in the business. Next q1 owner invested 700 000 in the business.

Prepare a journal entry to record this transaction. The long term investment is normally made for earning interest or. Read this article to learn about the transactions relating to investment account with its treatment.

Next q1 owner invested 700 000 in the business. The following journal entry examples in accounting provide an understanding of the most common type of journal entries used by the business enterprises in their day to day financial transactions. 320 investment securities 320 other than temporary impairments fsp fas 115 2 320 10 05.

On december 7 the company acquired service equipment for 16 000. The company paid a 50 down payment and the balance will be paid after 60 days. Example of jounal entry includes the purchase of machinery by the country where machinery account will be debited and the cash account will be credited.

Accta february 9 2018 journal entry examples. Accta february 9 2018 november 30 2018 journal entry examples. Government semi government corporation or trust securities such as shares bonds debentures etc.

Journal entry cash investment by. Additional information at 31 oct. Results of journal entry.

While introducing capital the firm receives cash and an increase in asset is debited therefore cash is debited. This will result in a compound journal entry. See this lesson on the journal entry for a capital investment by the owner.

Solved Required Complete The Following Journal Entries Chegg Com

Solved Required Complete The Following Journal Entries Chegg Com

Dividends Declared Journal Entry Double Entry Bookkeeping

Dividends Declared Journal Entry Double Entry Bookkeeping

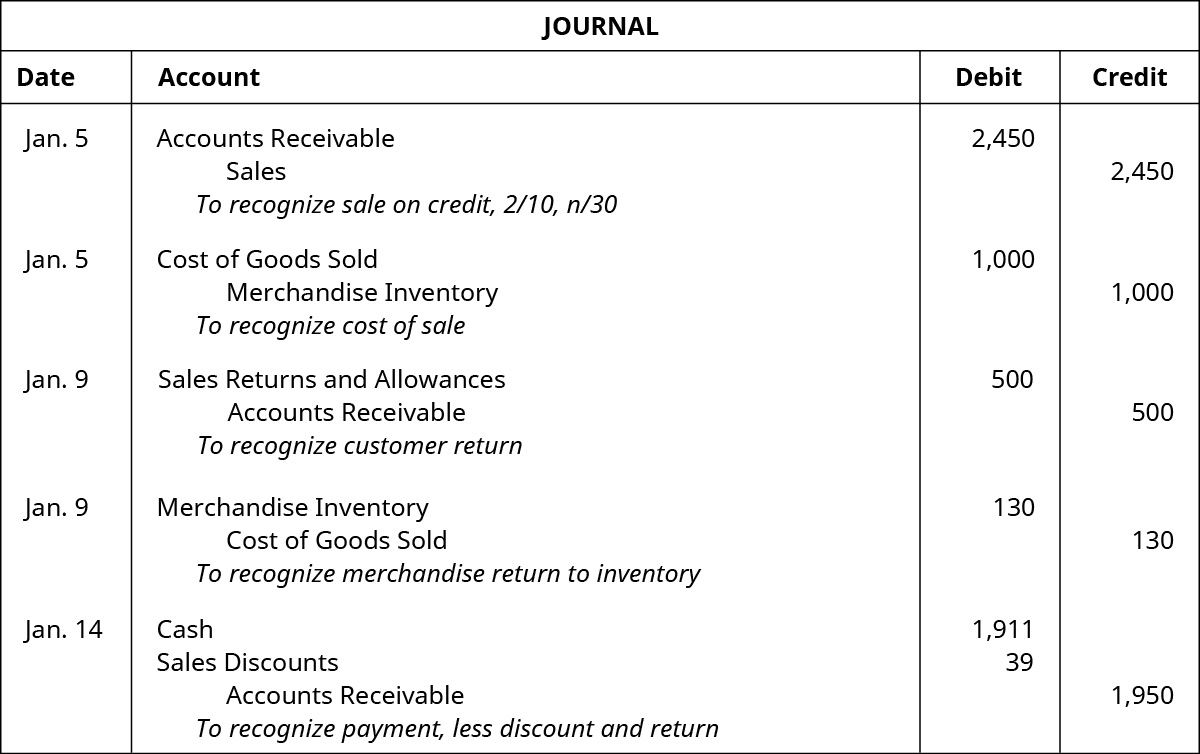

Solution To Requirement 2 Journal Entries For Additional Transactions Download Table

Solution To Requirement 2 Journal Entries For Additional Transactions Download Table

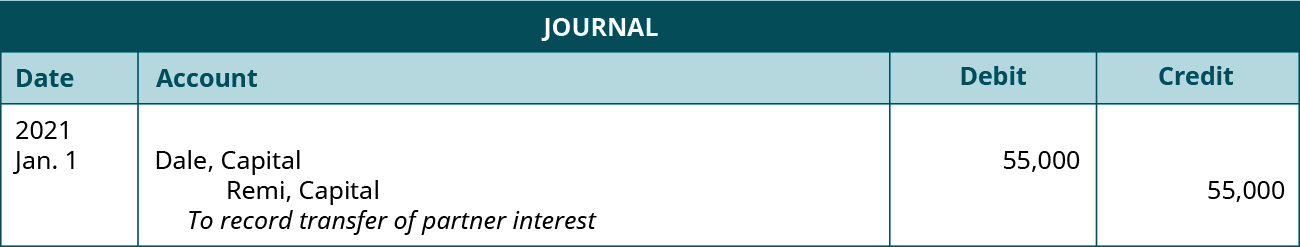

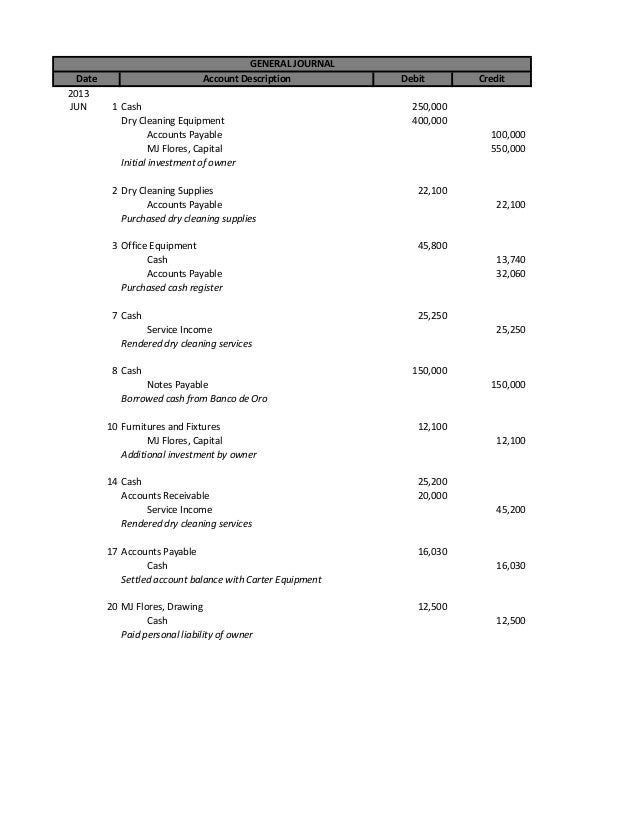

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

Capital Lease Accounting With Example And Journal Entries

Capital Lease Accounting With Example And Journal Entries

Accrued Expense Journal Entry Examples How To Record

Accrued Expense Journal Entry Examples How To Record

Accounting Journal Entries Cheat Sheet Accounting Career Accounting And Finance Cpa Exam

Accounting Journal Entries Cheat Sheet Accounting Career Accounting And Finance Cpa Exam

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

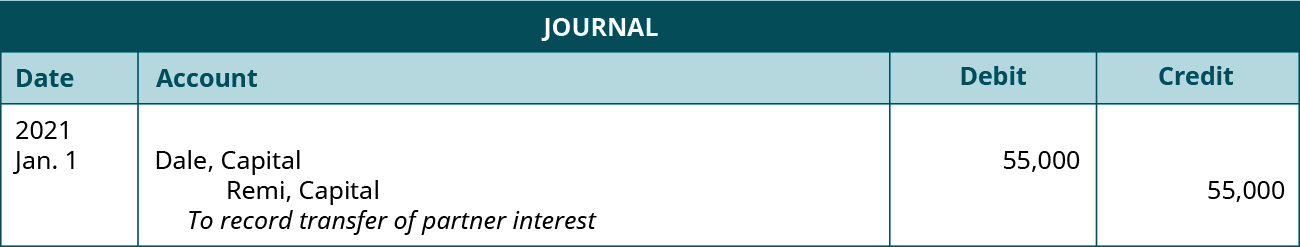

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Post a Comment for "Additional Investment Journal Entry"