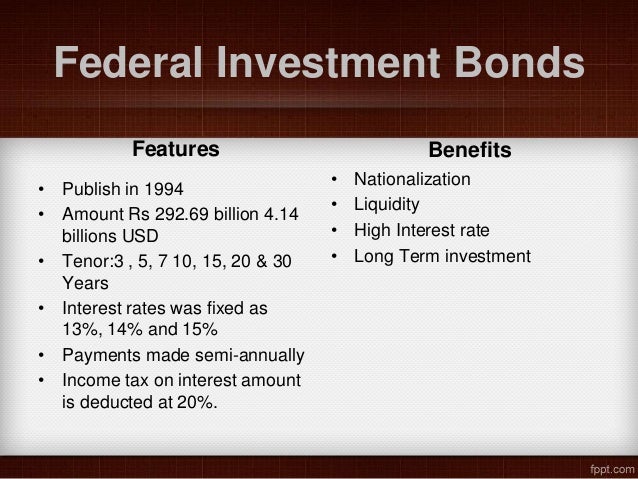

The yield on these bonds is fixed and disbursed semi annually. Government of pakistan.

The pakistan 10 years government bond has a 10 076 yield last update 6 dec 2020 11 15 gmt 0.

Pakistan investment bonds data. Pakistan investment bonds. These bonds are issued in denominations of multiples of rs 100 000 and available in tenors of 3 5 10 and 20 years. Bids rejected amount in pkr million price range amount in pkr million.

Current 5 years credit default swap quotation is 505 92 and implied probability of default is 8 43. Is a conventional fixed coupon bond bearing bond classification of par coupon. Stay on top of current and historical data relating to pakistan 10 year bond yield.

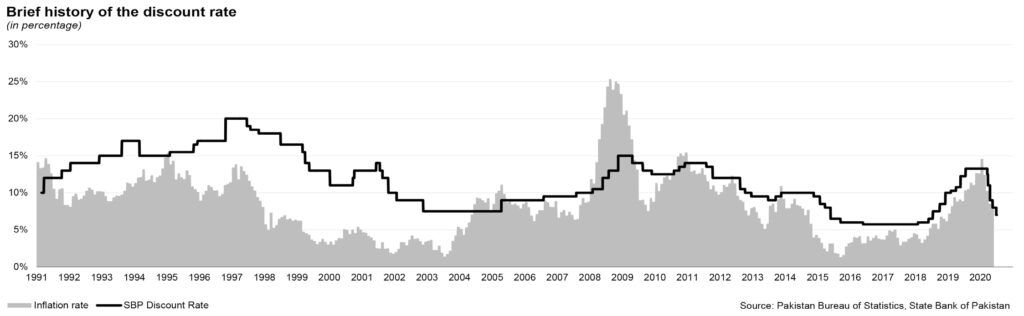

Central bank rate is 7 00 last modification in june 2020. Pakistan investment bonds pibs are debt securities issued by the state bank of pakistan. The pakistan credit rating is b according to standard poor s agency.

The coupon rate or semi annual return on these bonds are paid until maturity. Pakistan government bond 10y data forecasts historical chart was last updated on december of. This consists mainly of government bonds as the corporate market is yet to develop.

Created with highcharts 8 2 2. 3 5 10 years. Nazir baig created date.

Historically the pakistan government bond 10y reached an all time high of 95 15 in october of 2009. Pakistan 10y bond yield was 9 91 percent on friday december 4 according to over the counter interbank yield quotes for this government bond maturity. Pakistan investment bonds auction profile face value coupon rate amount in millions 1 december 14 2000 2 december 30 2000 february 14 2001 4 april 18 2001 5 may 21 2001 7 july 21 2001 coupon rate 10 september 22 2001 coupon rate 12 november 22 2001.

7 00 7 75 8 75 paid semi annually tenor. The bids received are as below. The pakistan 10y government bond has a 10 066 yield.

Yield changed 0 4 bp during last week 12 4 bp during last month 147 2 bp during last year. The pricing is based on market determined yields. Pakistan investment bond fh10 author.

Government bond market gained momentum after the introduction of pakistan investment bonds plbs in 2000 which helped to streamline the auction of government securities and to develop secondary market for the government paper. The yield on a treasury bill represents the return an investor will receive by holding the bond to maturity. Pakistan investment bonds fixed rate auction result 96 9647 95 6378 104 2091 103 6235 bids rejected 103 9158 103 9158 auction for 3 5 10 15 and 20 year pibs was held on nov 11 2020 with settlement date of nov 12 2020.

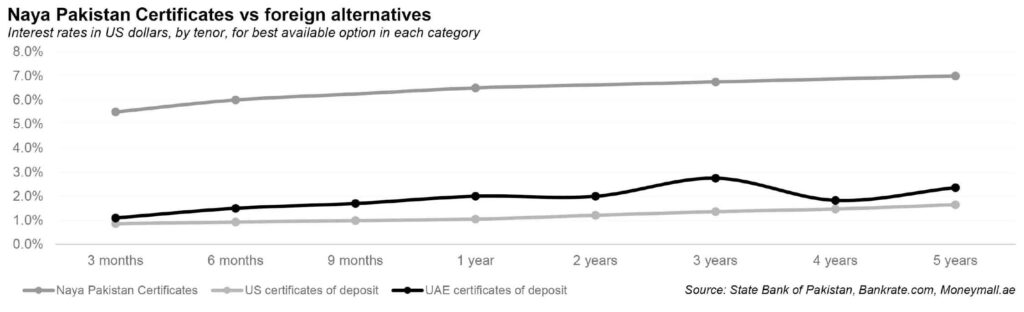

Naya Pakistan Certificates Are Ridiculously Attractive For Investors But Here Is Why That Is Bad For Pakistan Profit By Pakistan Today

Naya Pakistan Certificates Are Ridiculously Attractive For Investors But Here Is Why That Is Bad For Pakistan Profit By Pakistan Today

Ministry Of Finance Government Of Pakistan

What Is A Prize Bond Premium Bonds Pakistan Sukuk Bonds Pakistan Pakistan Investment Bonds

Types Of Prize Bonds In Pakistan Pakistan Stock Exchange

Https Dnb Sbp Org Pk Ecodata Bank 20 Non Bank Holding Of Gop Securities March 2018 Pdf

Debt Reprofiling Did The Finance Ministry Get It Right Profit By Pakistan Today

Debt Reprofiling Did The Finance Ministry Get It Right Profit By Pakistan Today

Pakistan Foreign Reserves And The Debt Crisis South Asia Lse

Pakistan Foreign Reserves And The Debt Crisis South Asia Lse

Pakistan Investment Bonds Pibs

Pakistan Investment Bonds Pibs

Risk Return Analysis Bonds Market In Pakistan

Risk Return Analysis Bonds Market In Pakistan

0 comments:

Post a Comment