In the meantime try out these free google sheets to help you build a well structured cap table along with a waterfall analysis for exit scenario modeling. For example a sponsor may only put in 5 of the investment capital but be entitled to 20 of the profits.

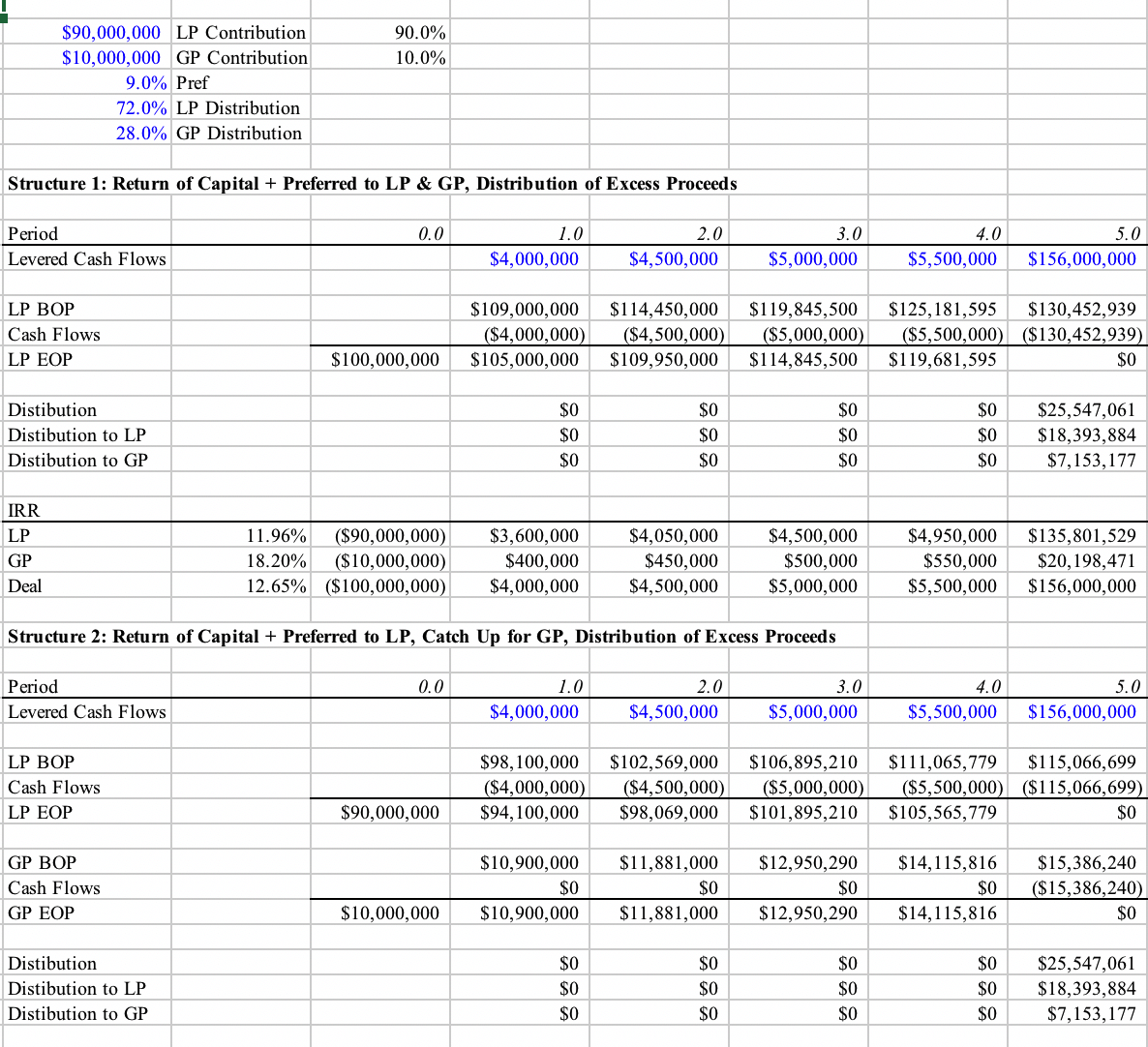

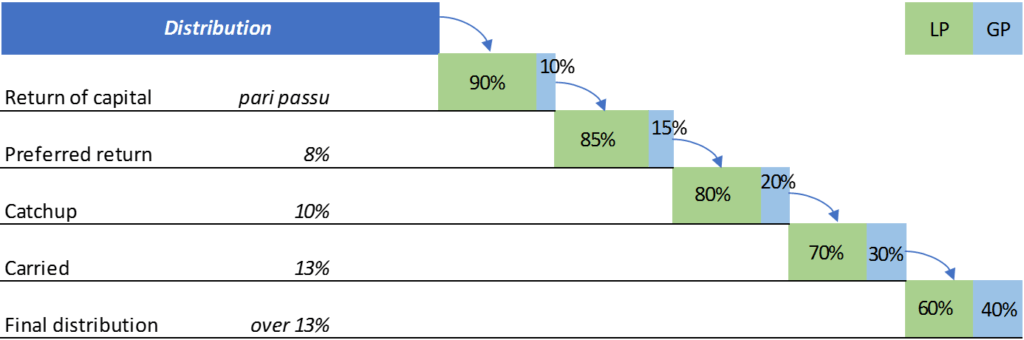

First 100 of all cash inflows to the lp until the cumulative distributions equal the original capital invested plus some preferred return.

Investment waterfall example. Real estate distribution waterfalls often follow a similar approach but the split between the gp and lp is more favorable to the gp. Download the series a cap table spreadsheet download the series a b cap table spreadsheet next up in this series. You might see a 50 50 split in place of an 80 20 split for example.

He gives examples from multiple real estate investing scenarios including a restaurant startup a rental property and a parking garage. Example of waterfall payments to demonstrate how a waterfall payment scheme works assume a company has taken loans from three creditors creditor a creditor b and creditor c. Sample whole fund waterfall clause 1.

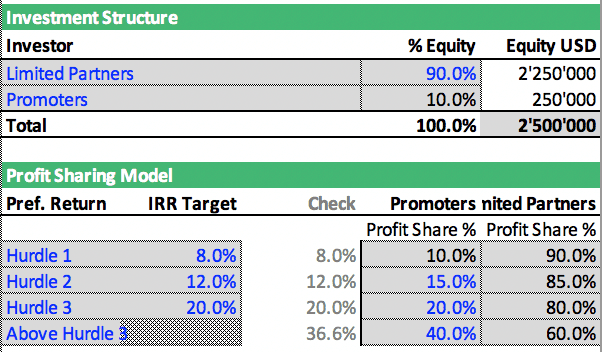

Investment proceeds from any portfolio investment will be initially apportioned among the partners including the general partner in proportion to their respective sharing percentages in respect of such portfolio investment. The waterfall defines the way in which cash distributions will be allocated between the sponsor and the investor. For example a waterfall could be structured that the gp gets 10 of the cash flow available for distribution and the lp gets 90 until the lps earn a return of 12 the return hurdle.

The investment waterfall now is built and cash flows are allocated. As you can see in the below table the deal shows an irr of 42 3. Multi tier real estate investment waterfall calculation example suppose we have a general partner and an outside investor who contribute a combined total of 1 000 000 into a project.

A distribution waterfall a way to allocate investment returns or capital gains among participants of a group or pooled investment. We now can summarize the key financial metrics for promoters and limited partners based on our waterfall model example. In this course professional investor symone he shows how to set up and use a waterfall framework to analyze the returns on an investment.

The general partner invests 10 or 100 000 and the outside investor contributes the remaining 90 or 900 000. Commonly associated with private equity funds the distribution. If the lps earn more than 12 the split changes so that the gp gets 20 and the lps get 80.

Seraf toolbox modeling tool for an early stage investment portfolio. In most waterfalls a sponsor receives a disproportionate amount of the total profits relative to their co investment. Distribution of investment proceeds.

Lbo Equity Waterfall Multiple Expansion

Pe Waterfall Modelling Catch Up Wall Street Oasis

Pe Waterfall Modelling Catch Up Wall Street Oasis

Will A Bank Deposit Double His Investment In 10 Years In 2020 Financial Asset Business Valuation Investing

Will A Bank Deposit Double His Investment In 10 Years In 2020 Financial Asset Business Valuation Investing

Distribution Waterfall Whiteboard Visual Overview Part 1 Of 5 Youtube

Distribution Waterfall Whiteboard Visual Overview Part 1 Of 5 Youtube

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcqju4n7ldebbzl5zrpwxsykye 8cavrq4p4zq Usqp Cau

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcqju4n7ldebbzl5zrpwxsykye 8cavrq4p4zq Usqp Cau

Waterfall Chart Studio Chart Waterfall Studio

Waterfall Chart Studio Chart Waterfall Studio

Waterfall Modeling Profit Distribution Performance Based Efinancialmodels

Waterfall Modeling Profit Distribution Performance Based Efinancialmodels

Waterfall Chart Using Error Bars Excel Chart Microsoft Excel

Waterfall Chart Using Error Bars Excel Chart Microsoft Excel

Distribution Waterfall First Excel Example Part 2 Of 5 Youtube

Distribution Waterfall First Excel Example Part 2 Of 5 Youtube

Bain Waterfall Chart Developed Economy Graphing Chart

Bain Waterfall Chart Developed Economy Graphing Chart

Distribution Waterfall Overview Importance Tiers

Distribution Waterfall Overview Importance Tiers

0 comments:

Post a Comment