Investment horizon is a term used to identify the length of time an investor is aiming to maintain their portfolio before selling their securities marketable securities marketable securities are unrestricted short term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company. Depending on the type of mutual funds the investment horizon for the same can be classified as short term long term and medium term funds.

Risk Tolerance Definition Types Top 5 Key Factors Of Risk Tolerance

Risk Tolerance Definition Types Top 5 Key Factors Of Risk Tolerance

Your investment horizon also known as investment time horizon refers to how long you expect your money to remain invested before you cash it in.

:max_bytes(150000):strip_icc()/GettyImages-838089780-eb5827c1bf6c41c99794fdd20d706c72.jpg)

Investment horizon meaning. Your investment horizon is the point in time when you hope to achieve a particular investment goal. The investment horizon is a key element of portfolio investing because it implies how long investors are willing to hold their portfolio based on the profit they aim to realize to compensate for the risk they have undertaken for investing in certain securities. Investment horizon is the term used to describe the total length of time that an investor expects to hold a security or a portfolio or the investment horizon designates how long an investor plans to hold its portfolio of securities to realize a profit based on the accepted risk.

The length of time a sum of money is expected to be invested. An investment time horizon is the period where one expects to hold an investment for a specific goal. Basics of investment horizon investment horizons can range from.

For example paying for college is often a fixed goal because. If you search the term investment horizon in the internet you can find various definitions such as. It is also called a time horizon.

In general the shorter the investor s horizon the less risk he she should be willing to accept. That horizon sometimes called your time frame may be fixed or flexible depending on the nature of the goal and the investment decisions you take. Usually young people set a longer investment horizon because they have more time to keep their portfolio invested and realize profits or offset the losses incurred.

The treasury department of a large corporation generally measures its horizon in days. However based on these definitions is it clear what does investment horizon exactly mean. Investment horizon is the term used to describe the time limit of investment.

What is investment horizon. How are mutual funds classified based on investment horizon. For example when a young man invests for a private pension his investment horizon is several decades away.

Stocks riskier and bonds. An individual s investment horizon depends on when and how much money will be needed and the horizon influences the optimal investment strategy. Investments are generally broken down into two main categories.

These funds usually have an investment horizon of 1 3 years. Investment horizon is the term used to describe the total length of time that an investor expects to hold a security or a portfolio. In this horizon if the time of deposit is low the funds are invested in safe securities and the returns are also less.

What Is Investment Horizon And How Does It Affect Mutual Fund Choices

What Is Investment Horizon And How Does It Affect Mutual Fund Choices

What Does It Mean To Say An Investor Has Short Horizon Quora

2 Explaining Time Horizons And Technology Investments Time Horizons And Technology Investments The National Academies Press

Investment Horizon Definition Overview And Types

Investment Horizon Definition Overview And Types

Lean Budget Guardrails Scaled Agile Framework

Lean Budget Guardrails Scaled Agile Framework

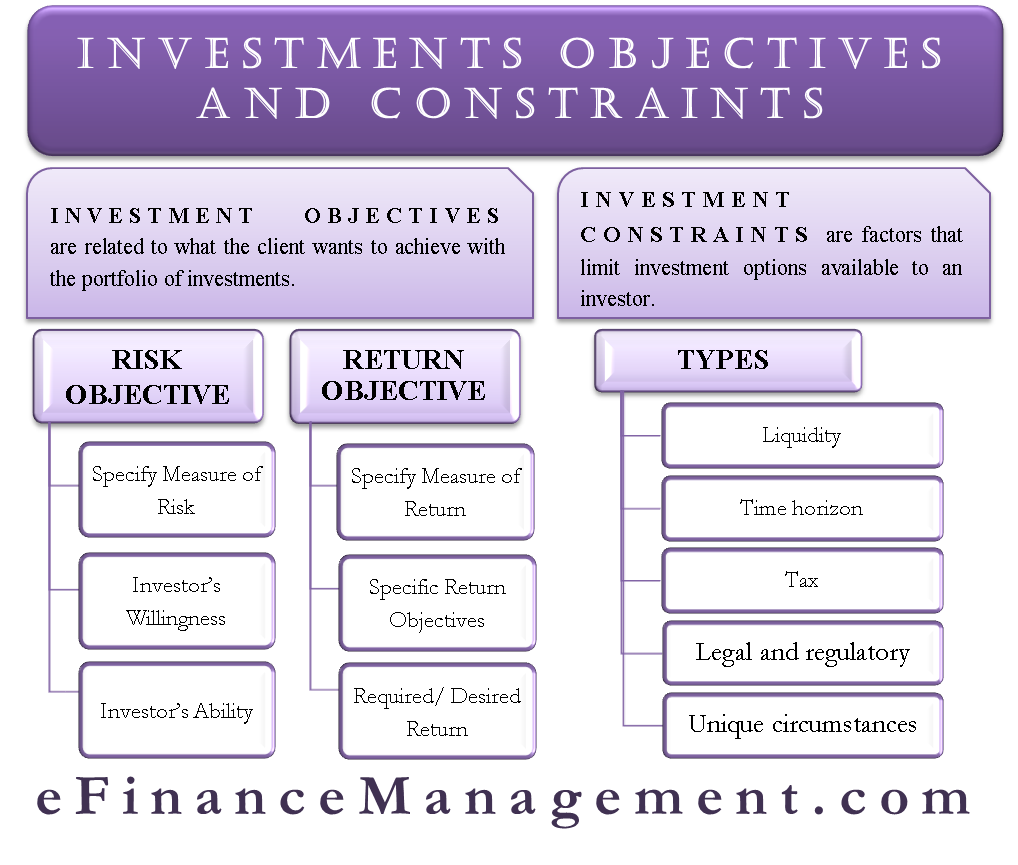

Investment Objectives And Constraints

Investment Objectives And Constraints

What Is My Investment Horizon Definition And Meaning Market Business News

What Is My Investment Horizon Definition And Meaning Market Business News

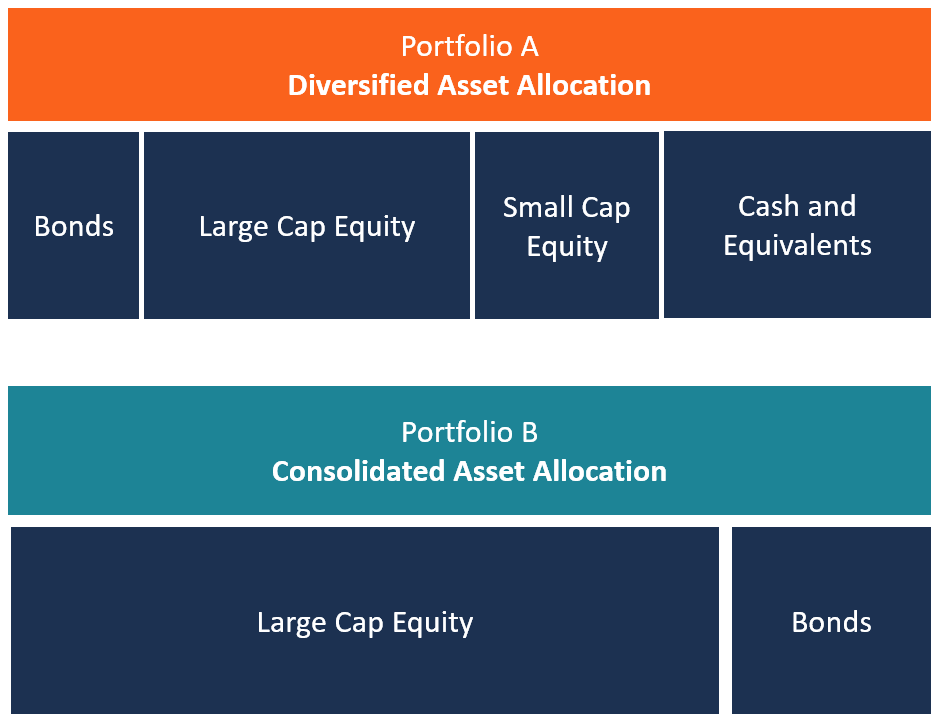

Asset Allocation Overview Examples Strategies For Asset Allocation

Asset Allocation Overview Examples Strategies For Asset Allocation

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png) How To Achieve Optimal Asset Allocation

How To Achieve Optimal Asset Allocation

/investment-bfe35975c7854c9995e43ec97a2b5589.jpg) Using Time Horizons To Reach Your Investing Goals

Using Time Horizons To Reach Your Investing Goals

0 comments:

Post a Comment