Initial equity method investment the first of the equity method journal entries to be recorded is the initial cost of the investment of 220 000. Dr dividend income p l r2 500.

Equity Method Ifrscommunity Com

Equity Method Ifrscommunity Com

In long or short term.

Investment in associate journal entries. Government semi government corporation or trust securities such as shares bonds debentures etc. The nature of the investment i e. Whether it is a share of common stock preferred stock a bond etc.

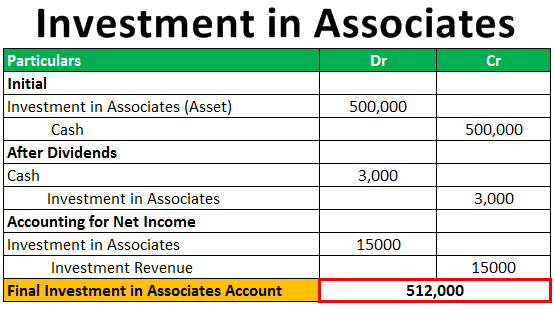

Company a purchased 25 000 of the 100 000 outstanding shares of company b at 10 per share on 1 jan 20x1. A gain on sale of investment arises when the disposal value of an investment exceeds its cost. Company b recognizes this using the following journal entry.

It may classify the investment differently depending on the type of marketable security marketable securities marketable securities are unrestricted short term financial instruments that are issued either for equity securities or for debt. Ias 28 outlines the accounting for investments in associates. The long term investment is normally made for earning interest or.

The investment is initially recognized at fair value which is the same as the price paid to acquire the holding in the associate company. An associate is an entity over which an investor has significant influence being the power to participate in the financial and operating policy decisions of the investee but not control or joint control and investments in associates are with limited exceptions required to be accounted for using the equity method. Fair value model debit.

Read this article to learn about the transactions relating to investment account with its treatment. An example can be found below but briefly the following points apply. 25 000 shares at 10 per share.

Investments are made in various securities e g. Accounting treatment of a disposal of investment depends on. When an investment in an associate or a joint venture is held by in entity that is a venture capital organization mutual fund unit trust or similar entity then investor might opt to measure investments at fair value through profit or loss under ifrs 9 and thus not apply equity method the same applies for the situation when an investor has an investment in an associate a portion of which is held by these organizations.

Accounting for investment in associates. The investor is deemed to exert significant influence over the investee and therefore accounts for its investment using the equity method of accounting. Cr investment in associate sfp r2 500.

Purchase and sale of investments. The journal entries may appear as follows depending on traderson s investment strategy and history. Usually the investor has significant influence when it has 20 to 50 of shares of another entity.

Investment in associates definition. Similarly a capital loss is when the value of investment drops below its cost. Investment in associate refers to the investment in an entity in which the investor has significant influence but does not have full control like a parent and a subsidiary relationship.

Ias 28 sets a clear framework for the way that an investment in an associate should be recorded. Then the journal entry required to account for the investment in the associate in accordance with the equity method and paragraph 14 8 a of the ifrs for smes will be. The cost of investment equals 250 000 i e.

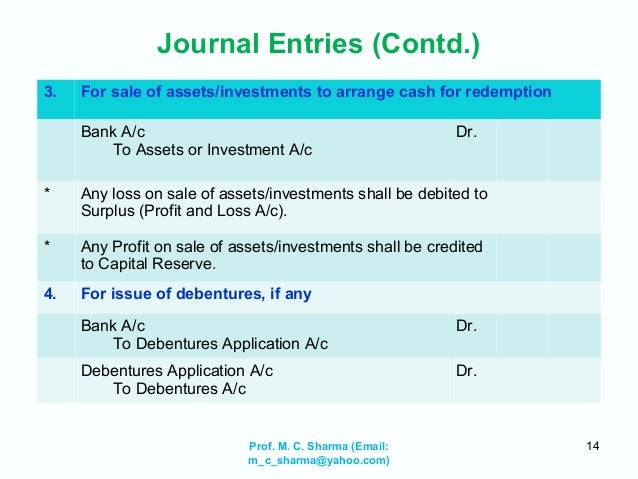

Buy Back Of Shares Introduction And Accounting

Buy Back Of Shares Introduction And Accounting

Motivations For Intercorporate Investments Ppt Video Online Download

Motivations For Intercorporate Investments Ppt Video Online Download

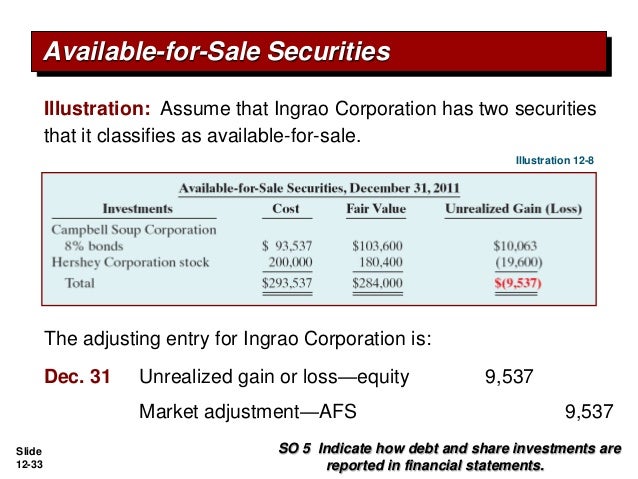

Pengantar Akuntansi 2 Ch12 Investment

Pengantar Akuntansi 2 Ch12 Investment

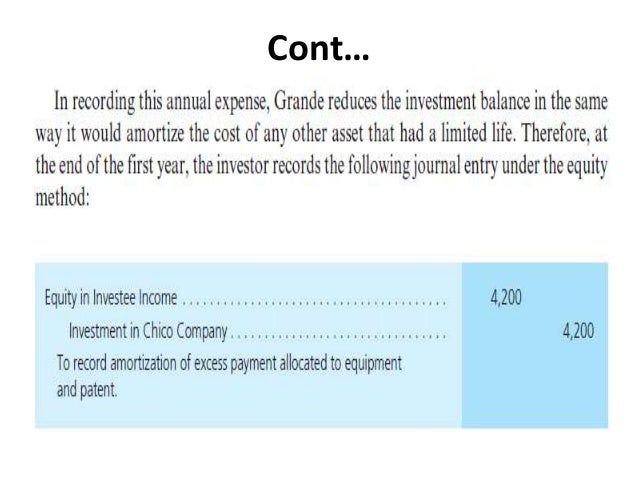

The Equity Method Of Accounting For Investments Ppt Download

The Equity Method Of Accounting For Investments Ppt Download

Equity Method Accounting Youtube

Equity Method Accounting Youtube

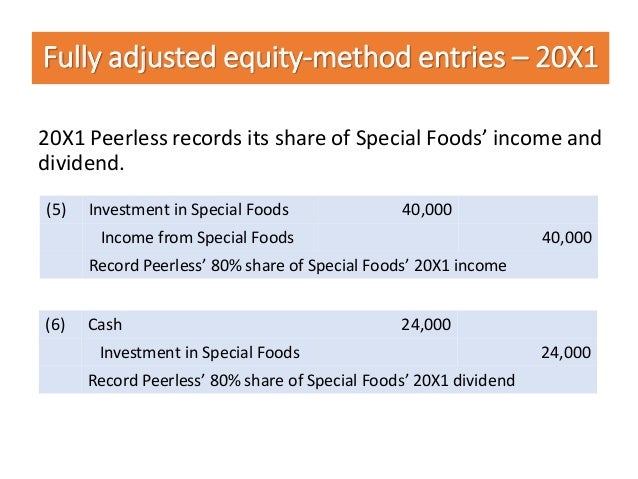

Advanced Accounting Fourth Edition Ppt Video Online Download

Advanced Accounting Fourth Edition Ppt Video Online Download

Intercompany Transaction Non Current Assets Part 1

Intercompany Transaction Non Current Assets Part 1

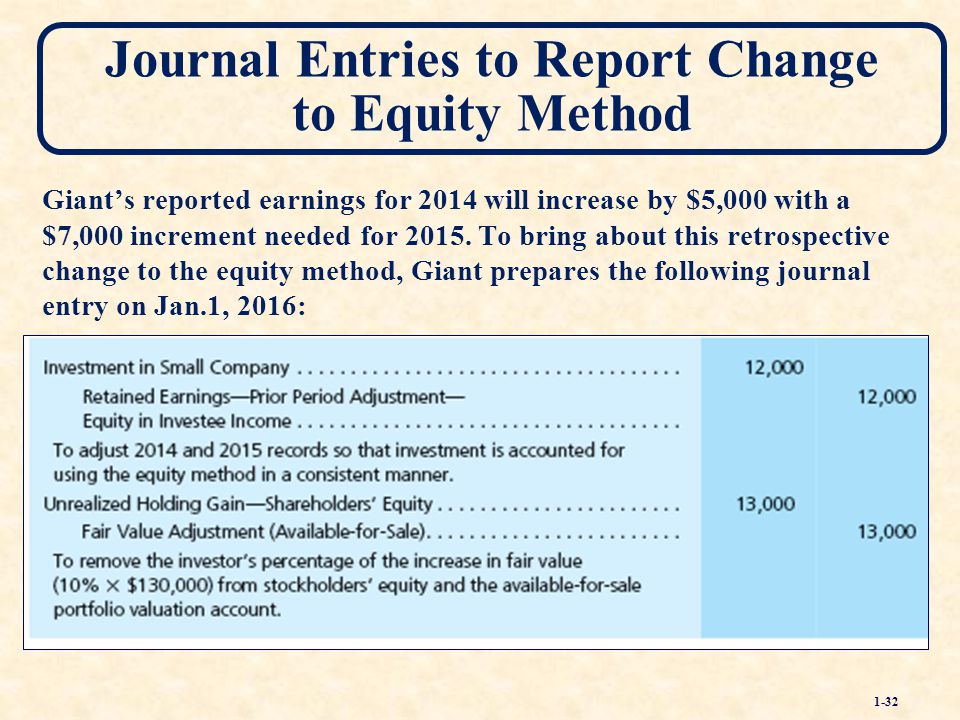

Advansed Accounting Ch 1 The Equity Method Of Accounting For Investm

Advansed Accounting Ch 1 The Equity Method Of Accounting For Investm

Https Www2 Deloitte Com Content Dam Deloitte Ng Documents Audit Financial 20reporting Ng Accounting For Investment In Associates5 Pdf

Investment In Associates Definition Accounting Top 3 Examples

Investment In Associates Definition Accounting Top 3 Examples

0 comments:

Post a Comment