Investment Equation Macroeconomics

Financial math formulas and financial equations. S i nx.

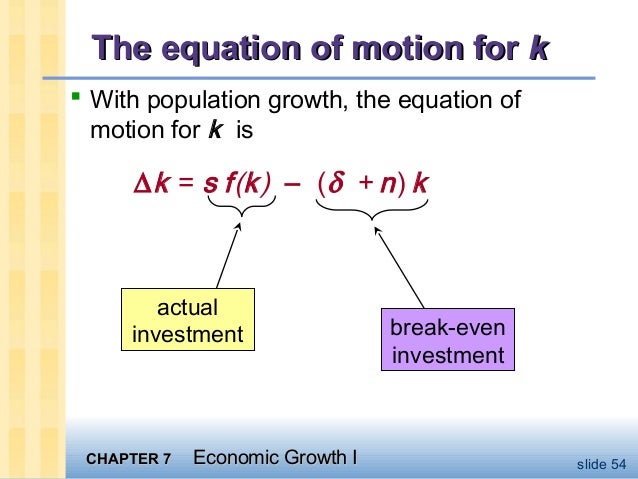

Total investment is the sum of net investment and the replacement investment.

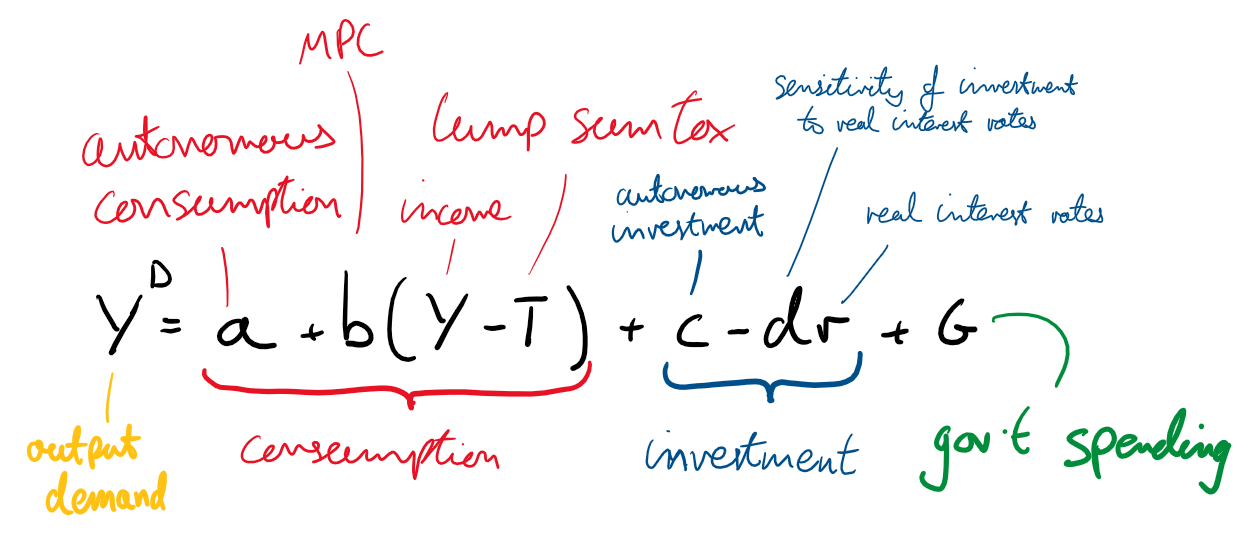

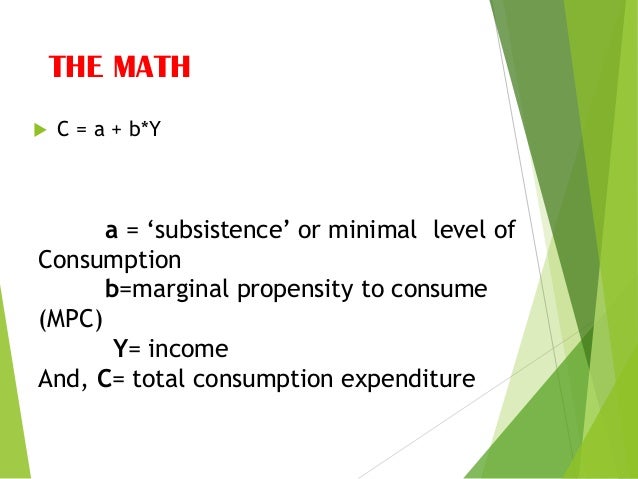

Investment equation macroeconomics. To calculate investment spending in macroeconomics we need to know a few formulas. Y c i g nx. The formula for calculating the investment multiplier of a project is simply.

Yet two equivalent interpretations are possible. In the macroeconomy we have our gross domestic product gdp formula which states that total output gdp y is equal to consumption c investment i government spending g and net exports nx. 1 1 m p c 1 1 mpc 1 1 m p c therefore in our above examples the investment multipliers would be 3.

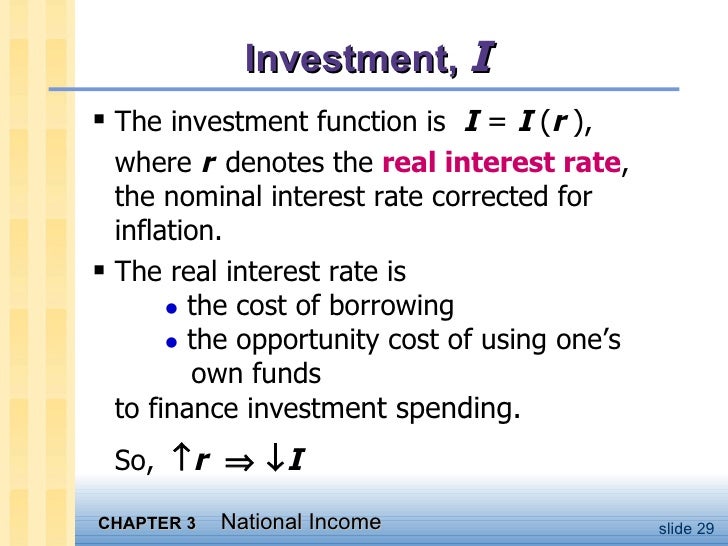

The equation has an important interpretation. The is lm model or hicks hansen model is a two dimensional macroeconomic tool that shows the relationship between interest rates and assets market. Thus investment is everything that remains of total expenditure after consumption government spending and net exports are subtracted i e.

In measures of national income and output gross investment represented by the variable i is a component of gross domestic product gdp given in the formula gdp c i g nx where c is consumption g is government spending and nx is net exports given by the difference between the exports and imports x m. In addition particulars related to certain financial instruments bonds for example are calculated using derivatives of these basic formulas. When looking at the basic macroeconomy we need to know what components make up gdp gross domestic product.

Net investment capital expenditures depreciation non cash regular investment in capital assets is critical to an enterprise s continuing success. The investment function is. I i n mp k p k p r δ δ k fixed investment depends on the mp k the cost of capital and the amount of depreciation.

Y c i g nx where y is gdp c is consumer spending i is investment g is government spending and nx is net exports. This equation is the corresponding relationship between investment i and saving s in an open economy one that trades with the rest of the world. Financial math has as its foundation many basic finance formulas related to the time value of money.

The intersection of the investment saving and liquidity preference money supply curves models general equilibrium where supposed simultaneous equilibria occur in both the goods and the asset markets. The formula for calculating net investment is. Change in real gdp investment multiplier 2 00 000 3 33 6 66 667 here again the investment of 2 00 000 would bring a change in the real gdp by 6 66 667.

The most basic equation for representing gdp is the following. This is because more saving leads to more investment which means more capital which means more future output. First the is lm model explains changes in national income when price level is.

Investment Spending Definition Formula Video Lesson Transcript Study Com

Investment Spending Definition Formula Video Lesson Transcript Study Com

Keynes Theory Of Investment Multiplier With Diagram

Keynes Theory Of Investment Multiplier With Diagram

The Neoclassical Theory Of Investment With Diagram

The Neoclassical Theory Of Investment With Diagram

Measuring National Income Gdp Economics Tutor2u

Measuring National Income Gdp Economics Tutor2u

Why Is Macroeconomics So Hard To Teach By Sam Povey Medium

Why Is Macroeconomics So Hard To Teach By Sam Povey Medium

Economics Formula List Of Macro Micro Economics Formulas

Economics Formula List Of Macro Micro Economics Formulas

2 Is Curve Macroeconomics Tutor

Determination Of Economic Equilibrium Level Of Output Micro Economics

Determination Of Economic Equilibrium Level Of Output Micro Economics

Consumption And Investment Function

Consumption And Investment Function

1 Aggregate Demand Macroeconomics Tutor

Post a Comment for "Investment Equation Macroeconomics"