Net Investment Equation

Net investment is the value of capital assets a business has acquired during an accounting period after depreciation allowances are subtracted. The net international investment position niip is the difference between the external financial assets and liabilities of a country.

The Neoclassical Theory Of Investment With Diagram

The Neoclassical Theory Of Investment With Diagram

The net investment income tax is applied to the lesser of the net investment income or the magi amount in excess of the predetermined limit.

Net investment equation. Using the formula above company xyz s net investment is. It is widely used in capital. For example a single tax filer with annual gross.

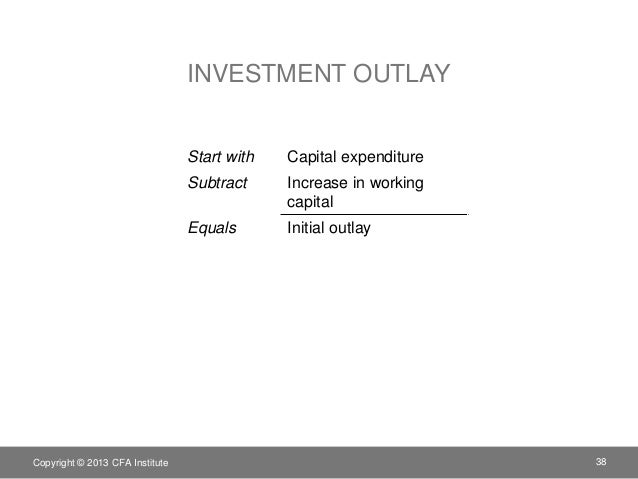

External debt of a country includes government debt and private debt publicly and privately held external assets by a country s legal residents are also taken into account when calculating its niip. The net working capital formula is calculated by subtracting the current liabilities from the current assets. The formula for calculating net investment is.

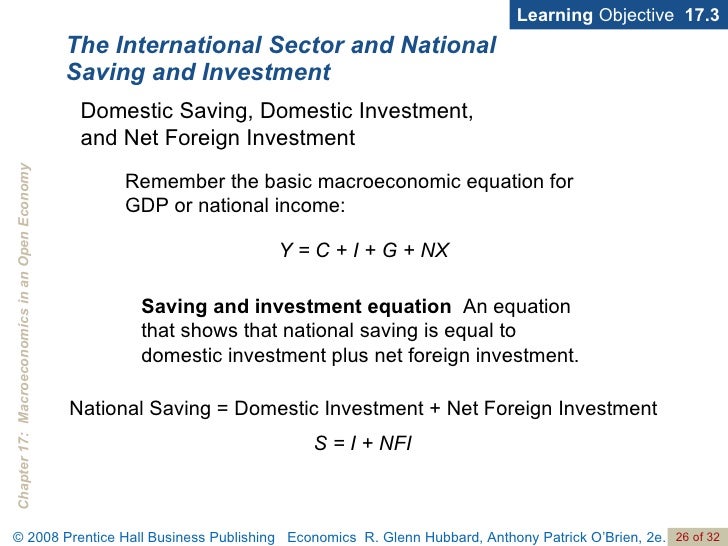

Net investment is the net amount invested by the company on its capital assets which is calculated as the capital expenditure for the period less non cash depreciation and amortization for the period and it indicates how much is the company investing in maintaining the life of its assets and attaining future growth in the business. Net investment 500 000 10 000 75 000 30 75 000 412 500 the concept of net investment is similar to net book value which is the cost of the asset minus accumulated depreciation. In equilibrium it must be the case that net foreign investment nfi is equal to net exports nx which are the value of exports minus the value of imports.

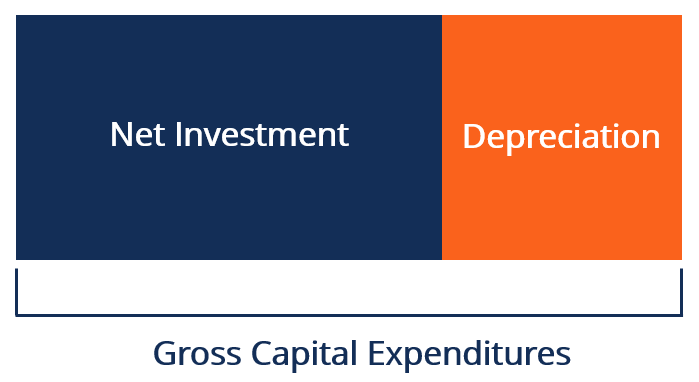

Here is what the basic equation looks like. If gross capital expenditures are higher than depreciation then the net investment will be positive which indicates that the productive capacity of a company is increasing. Net foreign investment nfi formula.

Net investment capital expenditures depreciation non cash regular investment in capital assets is critical to an enterprise s continuing success. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short term investments. Net present value npv is a method used to determine the current value of all future cash flows generated by a project including the initial capital investment.

Net investment takes depreciation into account thus it s a better measure of the rate at which a business is investing in itself than gross investment. Please note that commodities and currencies tend to follow a. For example suppose that country a gives 20 worth of bananas to.

This has to be true since two countries can trade in either a assets or b goods. Net investment is a good indication of how much is being invested in the productive capacity of a company especially if it is a very capital intensive business.

Cfa Corporate Finance Chapter2

Cfa Corporate Finance Chapter2

How To Calculate The Net Investment Income Properly

How To Calculate The Net Investment Income Properly

Net Investment Overview How To Calculate Analysis

Net Investment Overview How To Calculate Analysis

Difference Between Gross And Net Investment Youtube

Difference Between Gross And Net Investment Youtube

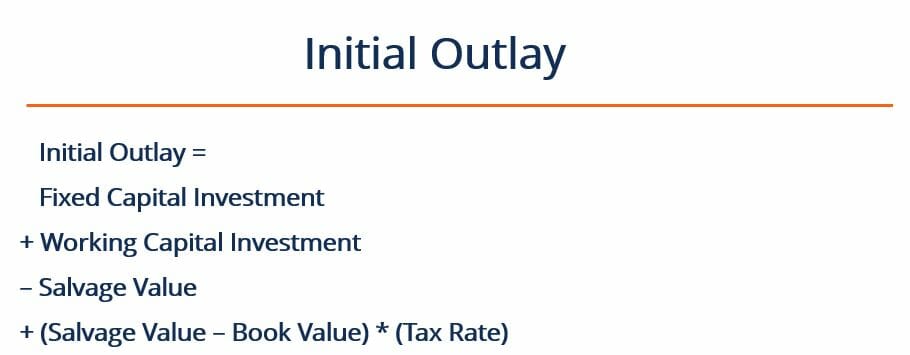

Initial Outlay Definition Explanation And Example Of Initial Outlay

Initial Outlay Definition Explanation And Example Of Initial Outlay

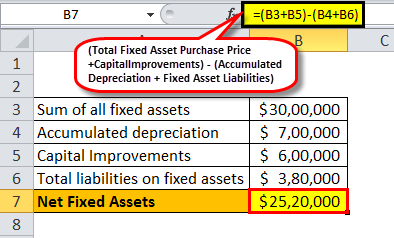

Net Fixed Assets Formula Examples How To Calculate

Net Fixed Assets Formula Examples How To Calculate

Guide How To Calculate Net Cash Flow In 4 Easy Steps Actioncoach

Guide How To Calculate Net Cash Flow In 4 Easy Steps Actioncoach

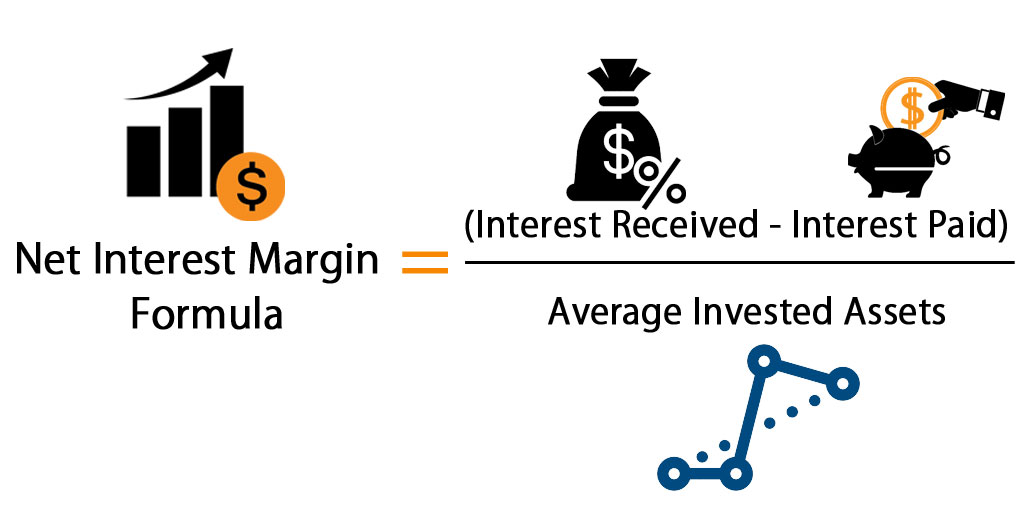

Net Interest Margin Meaning Formula How To Calculate Nim

Net Interest Margin Meaning Formula How To Calculate Nim

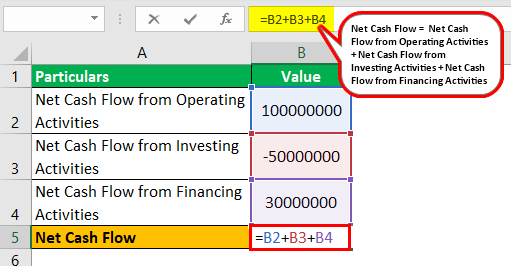

Net Cash Flow Formula Step By Step Calculation With Examples

Net Cash Flow Formula Step By Step Calculation With Examples

Post a Comment for "Net Investment Equation"