Investment Diversification Definition

Investment diversification includes a variety of asset classes asset categories and individual investments. A diversified investment is a portfolio of various assets that earns the highest return for the least risk.

What Is Portfolio Diversification Capital Com

What Is Portfolio Diversification Capital Com

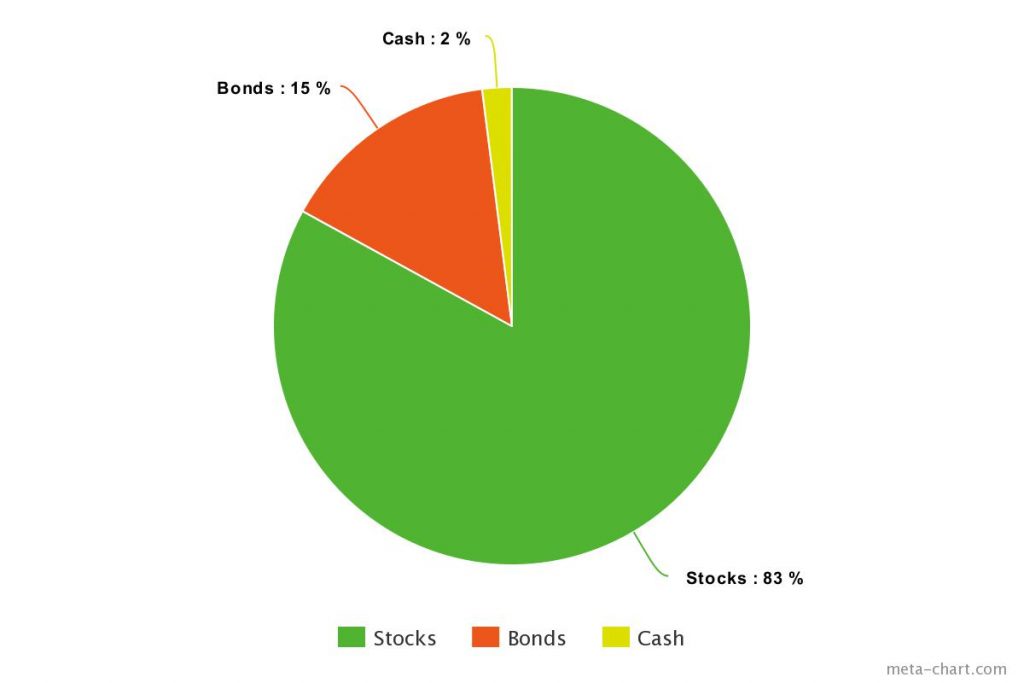

A typical diversified portfolio has a mixture of stocks fixed income and commodities.

Investment diversification definition. It s one of the most basic principles of investing. Diversification is a strategy that mixes a wide variety of investments within a portfolio. Be confident about your retirement.

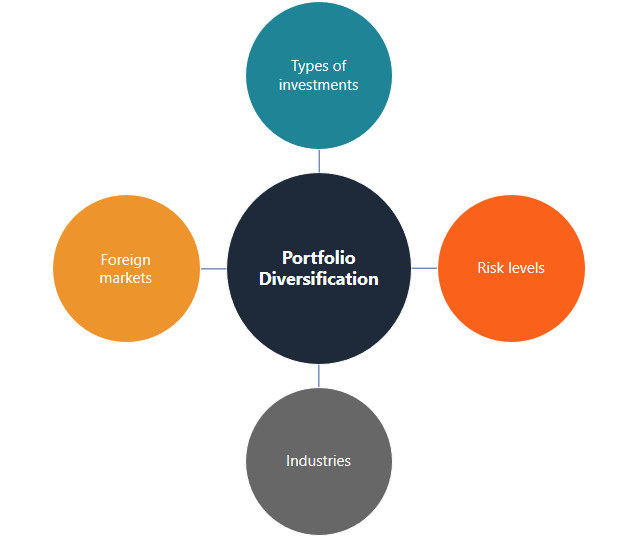

The purpose of investment diversification is to reduce unsystematic risk. Diversification is an asset allocation plan which properly allocates assets among different types of investment. This corporate strategy enables the entity to enter into a new market segment which it does not already operate in.

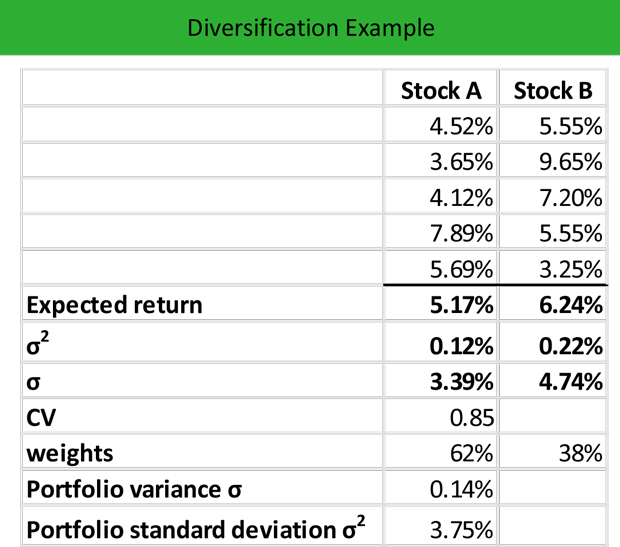

Diversification is a technique of allocating portfolio resources or capital to a mix of different investments. Diversification does however have the potential to improve returns for whatever level of risk you choose to target. Diversification is the act of or the result of achieving variety.

Consider for example an investment that consists of only stock issued by a single. The ultimate goal of diversification is to reduce the volatility vix the chicago board options exchange cboe created the vix cboe volatility index to measure the 30 day expected volatility of the us stock market sometimes called the fear index. The idea of diversification is to create a portfolio that includes multiple investments in order to reduce risk.

To build a diversified portfolio you should look for investments stocks bonds cash or others whose returns haven t historically moved in the same direction and to the same degree. Find an investing pro in your area today. A well diversified stock portfolio for example might include small medium and large cap domestic stocks stocks in six or more sectors or industries and international stocks.

Diversification is the strategy of spreading out your money into different types of investments which reduces risk while still allowing your money to grow. Diversification is an investment strategy in which you spread your investment dollars among different sectors industries and securities within a number of asset classes. Portfolio holdings can be diversified across asset classes and within classes and also geographically by.

Diversification is an act of an existing entity branching out into a new business opportunity. Investors accept a certain level of risk but they also need to have an exit strategy if their investment does not generate the expected return. Diversification works because these assets react differently to the same economic event.

The decision to diversify can prove to be a challenging decision for the entity as it can lead to extraordinary rewards with risks.

Why Portfolio Diversification Isn T Dead In The Least Retirement Portfolio Investment Portfolio Finance Investing

Why Portfolio Diversification Isn T Dead In The Least Retirement Portfolio Investment Portfolio Finance Investing

Over Diversification Hurting Your Investment Returns Arbor Asset Allocation Model Portfolio Aaamp Value Blog

Over Diversification Hurting Your Investment Returns Arbor Asset Allocation Model Portfolio Aaamp Value Blog

Portfolio Diversification How To Diversify Your Investment Portfolio

Portfolio Diversification How To Diversify Your Investment Portfolio

Diversification Definition Day Trading Terminology Warrior Trading

Diversification Definition Day Trading Terminology Warrior Trading

Diversified Portfolio Examples I Will Teach You To Be Rich

Diversified Portfolio Examples I Will Teach You To Be Rich

Diversification And Correlation How To Create A Well Balanced Portfolio Investment Fund

Diversification Finance Overview Definition And Strategy

Diversification Finance Overview Definition And Strategy

Diversification Return With Less Risk Personal Finance

Diversification Return With Less Risk Personal Finance

Naive Diversification Definition Capital Com

Naive Diversification Definition Capital Com

What Is Diversification Definition Meaning Example

What Is Diversification Definition Meaning Example

Post a Comment for "Investment Diversification Definition"